My firm, EyeQ Research, recently conducted a survey of the membership of the American-European Congress of Ophthalmic Surgery (AECOS). According to the organization’s mission statement, AECOS is a progressive group that fosters communication and cooperation among leading anterior segment surgeons, ophthalmic industry executives, select venture capitalists, and technology entrepreneurs. Today, this society remains dedicated to advancing vision care and improving patients’ quality of life through innovation, education, and advocacy.

The topics for the survey, which covered trends in the premium practice, were chosen by a poll of AECOS physician members. The top two technologies chosen were laser cataract surgery and intraoperative aberrometry, and the top two subject areas were technology assessment and pearls for practice success.1

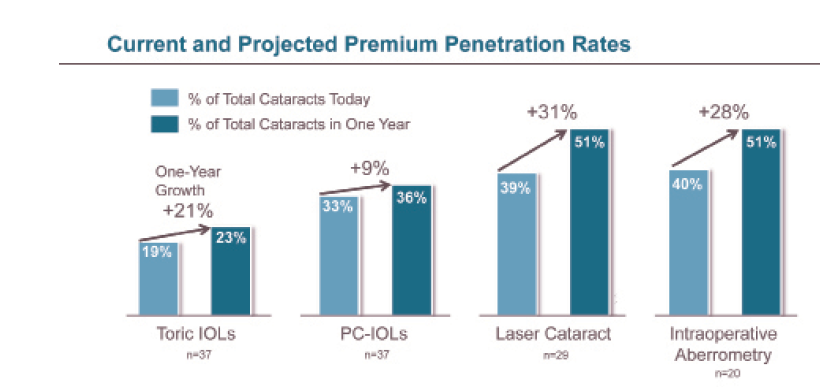

The 35% response rate was heavily weighted toward US respondents, and it must be noted that AECOS membership does not represent a random sampling of the broader ophthalmic surgeon population. The members tend to be early adopters with above-average use of advanced technology. Among the survey participants, the current average penetration rates for toric and presbyopia-correcting IOLs were 19% and 33%, respectively, and for both laser cataract surgery and aberrometry were 40%, expected to reach about 50% 1 year from now. These premium technology penetration rates among AECOS survey participants far exceed the single-digit penetration rates for the overall market (Figure 1).

LASER CATARACT SURGERY ADOPTION

In the survey, 78% of surgeons said they are currently performing laser cataract surgery versus an estimated 16% of US cataract surgeons overall. Among respondents, the average time using the laser was about 24 months. These surgeons report using the laser in an average of 40% of their cataract procedures. Interestingly, although the LenSx Laser (Alcon) has the majority share of this market, the four available lasers were roughly equally represented among this group.

Figure1. Current and projected premium penetration rates according to AECOS members.

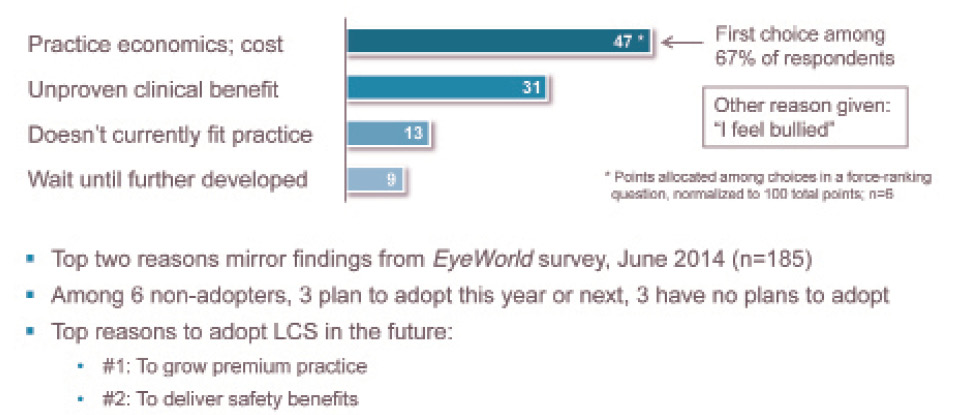

Figure 2. Reasons for not adopting laser cataract surgery so far.

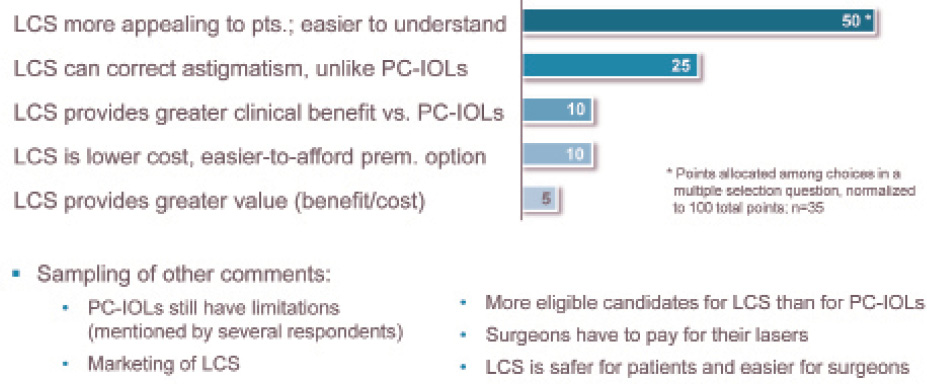

Figure 3. Why is laser cataract surgery market penetration surpassing that of presbyopia correcting IOLs in the United States?

The 22% of nonadopters in the group were asked why they have not yet adopted laser cataract surgery (Figure 2). The most popular reply by far was practice economics and cost, followed by a feeling that the technology offers an unproven clinical benefit. When asked for other reasons for not adopting, one surgeon commented, “I feel bullied.”

Surgeons were asked why they think the laser is poised to surpass the 6% penetration rate that is currently seen with presbyopia-correcting IOLs even though the laser has been available for a much shorter time and requires a much larger capital investment (Figure 3). By far, the top reason was that the laser is more appealing to patients and easier for them to understand. The second reason was that the laser can correct astigmatism, and until recently, presbyopia-correcting IOLs that correct astigmatism were not available in the United States. Very few surgeons said that laser cataract surgery provides greater value and clinical benefit than presbyopia-correcting IOLs.

INTRAOPERATIVE ABERROMETRY ADOPTION

Among the respondents, 51% are currently performing intraoperative aberrometry versus an estimated 13% overall among US cataract surgeons. On average, the AECOS surgeons have about 3.5 years of experience with aberrometry. This clearly illustrates the early-adopter bias within the surveyed group, given the fact that most US surgeons who have adopted the technology have done so within the past 2 years. On average, aberrometry is being used in about 40% of cases for this group, and they responded that the technology leads to an IOL power change about 30% of the time.

The 49% of respondents who are not currently performing aberrometry said that cost is the most important barrier, just as it is with the femtosecond laser. “Unproven clinical benefit” appears to be less of a barrier to adoption for aberrometry than it is for laser for cataract surgery. The second most common reason for not adopting aberrometry was a preference for waiting until the technology is further developed and more widely used. Among reasons to adopt aberrometry in the future, superior refractive outcomes was the top choice, followed by safety benefits.

THE LASER’S IMPACT ON CLINICAL OUTCOMES

With regard to the question of whether the laser improves refractive outcomes and procedural safety in cataract surgery, there was a positive bias but certainly not a consensus. About one-quarter of respondents said that the laser does improve outcomes and that this has been proven in clinical studies. More than one-third of respondents said that they believe the laser improves outcomes but that it has not yet been proven. On the other end of the spectrum, about 15% of surgeons said that the laser does not improve outcomes, and two stated that the laser actually makes cataract surgery less safe at this time.

Among laser users, feedback regarding the device’s impact on outcomes was more favorably biased, with about two-thirds of respondents saying that the laser has improved refractive and safety outcomes in their hands.

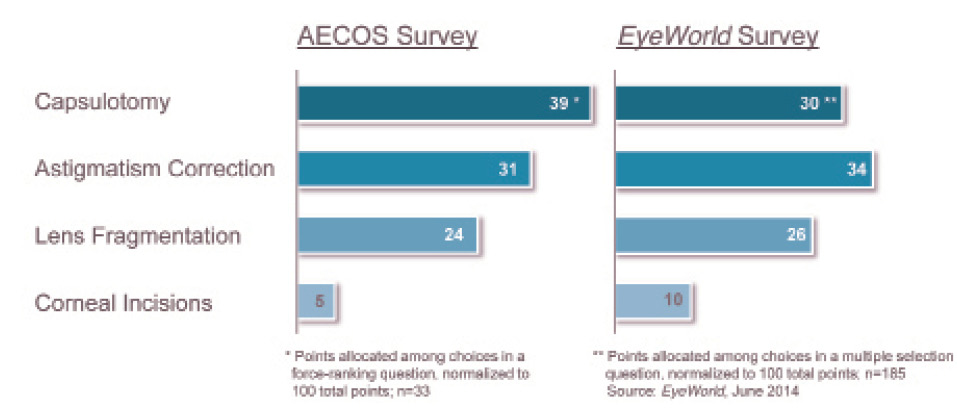

Surgeons were also asked to rank which of the laser’s functions add the most value and clinical benefit to cataract surgery (Figure 4). The top three choices were capsulotomy, astigmatic correction, and lens fragmentation, in that order, with corneal incisions placing a very distant fourth.

SURGEONs’ SATISFACTION WITH LASER CATARACT procedure

Laser users were asked if there are any approved functions of the laser that they are not routinely using, and nearly two-thirds answered yes to this question. About 75% of those surgeons said that they are not routinely using the laser for their corneal incisions, and nearly 20% said they are not routinely using the laser for astigmatism-correcting incisions. It should be noted that all four marketed lasers are represented in these survey results; this is not an issue with just one or two lasers.

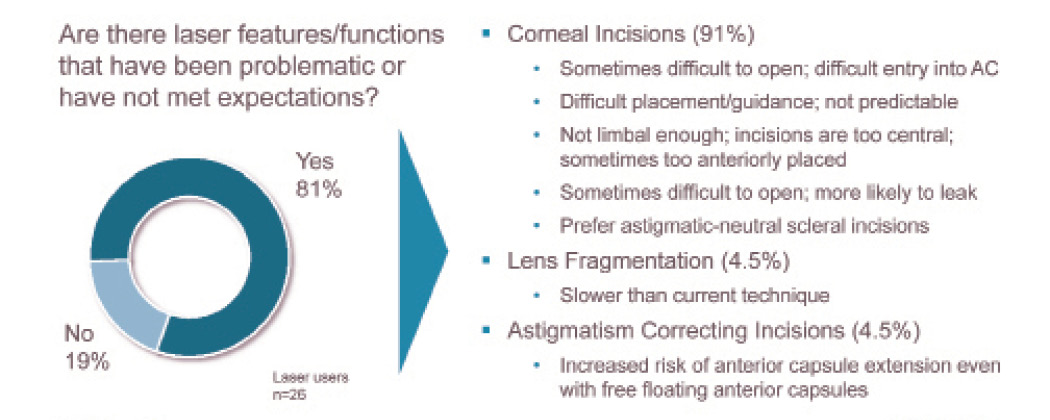

Addressing the same topic from a slightly different angle, AECOS surgeons were asked whether there are laser features or functions that have been problematic or have not met their expectations (Figure 5). To this, 81% of respondents answered yes, and not surprisingly given the results of the previous question, the vast majority of dissatisfaction was associated with corneal incisions. Respondents noted incision-related issues such as surgical difficulty, incision location, predictability, and leakage.

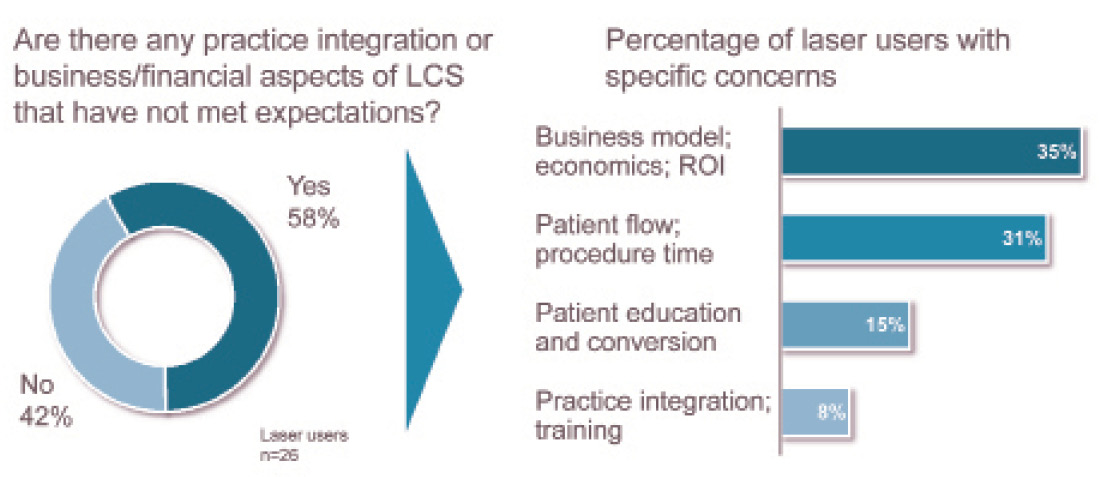

Similarly, participants were asked if there are any business, financial, and practice integration aspects of laser cataract that have not met expectations (Figure 6). Nearly 60% answered yes to this question, and the top two areas of concern were laser economics and patient flow. When surgeons were asked directly about their satisfaction so far with laser cataract economics, the responses had a positive bias, with the largest group (38% of respondents) saying that they were very satisfied and another 31% expecting the laser to have a positive financial return over time. About 25% of the respondents said it is too soon to know, and two surgeons (8%) said the laser is generating an unacceptable financial return.

It is encouraging to note that impressions regarding laser cataract economics appear to be time dependent. Among survey respondents, the surgeons who were the most satisfied were the ones who had had the laser the longest—2 to 3 years, on average. Those who said that they were uncertain about the return on investment, or that it was too soon to know if it will be positive, have had the laser for less than 1 year on average.

PERCEIVED BENEFITS FOR PATIENTS

To address the perceived benefits of various premium cataract technologies, participants were asked to rank four premium technologies with respect to patient value, defined as “benefit delivered per dollar paid” by patients. Toric IOLs came out on top, followed by presbyopia-correcting IOLs, aberrometry, and laser cataract surgery, in that order. Among surgeon respondents who were active users of all four premium technologies, the results were much more evenly distributed, with toric IOLs just slightly ahead of the other three. With respect to their impact on improving refractive outcomes in cataract surgery, aberrometry was ranked significantly higher than femtosecond lasers.

Figure 4. Where the laser adds the most value and clinical benefit.

Figure 5. Laser cataract functions not meeting expectations.

Figure 6. Laser cataract surgery business/financial aspects not meeting expectations.

PRICING AND MARKETING PREMIUM TECHNOLOGY

In the survey, 81% of respondents said that they offer an all-in-one package that includes applicable refractive cataract technologies—diagnostics, IOL, and/or laser. The average fee for a bundle of this type is approximately $3,500 per eye. When billed separately, the average fee for use of the laser for astigmatic correction with conventional IOLs is about $550 and about $400 to $450 with premium IOLs. The average fee for use of intraoperative aberrometry is about $450, although most surgeons include aberrometry as part of a larger premium bundle.

With regard to marketing, 65% of respondents said that they are currently marketing or advertising outside of the practice, with most surgeons advertising laser vision correction, followed by premium IOLs, and then laser cataract

surgery.

Annual advertising budgets varied widely among the respondents. The average was $134,000, and the median was $50,000. The most effective type of media according to the AECOS participants was online, including practices’ websites, social media, and online advertising. Based on the percentage of surgeons that utilize each type of medium, online media use is clearly outpacing more traditional forms of media such as print, radio, TV, and direct mail.

PEARLS AND PITFALLS

Finally, respondents were asked for pearls for practice success and pitfalls to avoid with laser cataract surgery. The number one pearl for success suggested by survey respondents was to offer the technology broadly to patients, including premium IOL patients and astigmatic candidates. The second most common pearl offered was to believe in the technology and communicate this commitment and enthusiasm to staff and patients. The third pearl was to bundle the laser with other technologies in a single package price to simplify options and reduce

confusion.

In terms of the barriers to success and pitfalls to avoid, three items were mentioned in roughly equal numbers. These largely mirrored the pearls for success, viewed from the opposite perspective. The top three pitfalls were:

(1) not taking the time to educate patients and make them aware of the technology, (2) having doubts and uncertainty regarding the clinical benefits and not fully committing to the technology, and (3) operational issues such as poor planning and execution.n

1. Lachman M. 2014 AECOS survey: trends in the premium practice. Presented at: AECOS Summer Symposium; July 24, 2014; Deer Valley, UT.

Michael Lachman

- president of EyeQ Research, which provides strategic advisory and market research, analytics, and insights to the ophthalmic industry

- (925) 939-3899; michael@eyeqresearch.com