On November 17, 2014, in what would be the year's largest acquisition in any industry, Actavis announced plans to acquire Allergan for $66 billion in cash and stock. Actavis, a specialty and generic drug maker, said it would pay $219 per Allergan share, made of about 60% in cash and the rest in Actavis stock.

Although the transaction is subject to the approval of shareholders of both companies as well as regulatory clearances, the combination, if approved, will create one of the top 10 global pharmaceutical companies by sales revenue, with combined annual pro forma revenues of more than $23 billion anticipated in 2015.

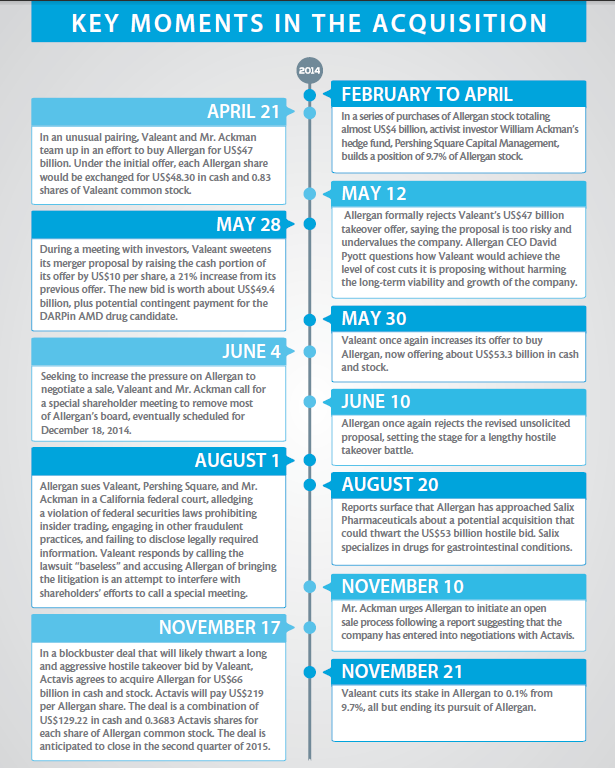

Days after the deal was announced, Actavis President and CEO Brent Saunders and Allergan Chairman and CEO David Pyott spoke with Stephen Daily, Executive Editor, News, at Bryn Mawr Communications. They answered a variety of questions related to the deal, including reaction to the long and aggressive hostile takeover bid for Allergan by Valeant Pharmaceuticals International (see Key Moments in the Acquisition).

Stephen Daily: Thank you both for joining me today. Brent, Actavis announced that it is going to pay $219 a share for Allergan. That is about $85 a share more than the value of Allergan stock before the company was targeted earlier this year. What factors went into determining that price, and what assets does Allergan possess to justify that price?

Brent Saunders: Allergan is the best company in our sector. It has performed in the top quartile of performance for the past 15 years. It is a company with probably the most talented people in the sectors in which they compete. It holds leadership positions in all the therapeutic categories in which it competes. It has a terrific research and development [R&D] pipeline and a portfolio of products that have great innovation and long lives. The industrial logic and strategic rationale for putting our companies together was compelling. I think the price we paid is a fair price, but I think it is a value. It is a price that creates value for Actavis and Allergan shareholders for the long term.

Mr. Daily: David, what factors were considered by you and your team when deciding to move forward with the Actavis offer?

David Pyott: One important thing when we talk about value is that we believe that the unaffected stock price before Pershing Square started accumulating shares—from our point of view, illegally, and we are continuing with our insider trading lawsuit against Pershing Square—was about $123 to $124. In the world of mergers and acquisitions, companies pay a premium over a trading price. I think it is important to talk about the fact that we realized that top performance, and that was very much part of our plan to defend ourselves: to realize value not just for our stockholders, but to take care of the interests of our other stakeholders.

2014 was the best year in terms of sales growth in our 64-year history. In the second quarter, on a local currency basis, the company grew 16%. In the third quarter, it was 18%. Echoing what Brent has said, we are a high-performing company, which makes us extremely valuable. I think it is also clear that we are the fastest-growing integrated eye care company in the world, per IMS Health, growing about 14% in market worldwide. That is in excess of the world market growing at about 9% or 10%—double the speed of some of our major fully integrated competitors.

In terms of how did we end up with Actavis, we had to come to a price that was a fair price for Allergan stockholders but also that worked for Actavis stockholders. We are integrated now in our view, because beyond the cash component of the transaction, we also happily accepted 41% of the consideration in Actavis stock. Because when we did reverse due diligence on Actavis on behalf of our stockholders, we were happy with what we saw. We buy into the vision of Brent Saunders and his team, and we believe there is a cultural fit.

Mr. Saunders: I think you hit the nail on the head. It is a complementary culture. I think we [Allergan and Actavis] view innovation as incredibly important. We view supporting the medical communities in which we operate as crucial, and we view supporting our brands and people as compelling.

Mr. Daily: With regard to the terms of the deal, in order to reach its financial targets, Actavis said it plans to cut about $1.8 billion in costs. That includes $400 million in R&D spending. The figure is less than the $900 million that Valeant said it would cut if it succeeded in its takeover bid. Can you elaborate on how Actavis came to that figure and where these synergies are going to be realized?

Mr. Saunders: I would just step back and say that the actual cost synergies are more in the line of $1.3 billion, not $1.8 billion. There are about $500 million of financial synergies that do not require any cutting. It is just the structure of our company versus Allergan. The $400 million as compared with the $900 million is off of a much larger base of spend. This year, we will spend about $1.2 to $1.3 billion in our own right. When you combine the two companies' R&D spend, without any cuts, it is well over $2 billion. When you look at the other company [Valeant], they spend about $300 million on research. So, the $900 million was essentially cutting the entire Allergan R&D budget. Just to give you an apples-to-apples comparison: The $400 million represents about an 18% cut of R&D, whereas the $900 million [that Valeant proposed] represented for them what, David, about a 70% cut of R&D?

Mr. Pyott: It was 69% in a deck they filed on Monday.

Mr. Saunders: It is misleading to say that we are cutting half. We are cutting half but off a much larger base of spend between the two companies. That is important perspective.

That $400 million [in R&D cuts] is our first estimate. It is a number that we have come to by going through due diligence, spending time with the R&D leadership at Allergan, working at our own cost structure at Actavis and our R&D organization. We feel that a little more than half of that can come from back-office and the administrative and management side of R&D, not programs—things like pharmacovigilance, clinical trial management, informatics, and medical writing. And the reason we can do that is because of scale.

The other half will be from programs, but we will put all the Actavis and Allergan programs on the table. Those will not come out of just ophthalmology or aesthetics. They could come out of central nervous system. They could come out of gastroenterology. They could come out of women's health. We are going to put our best programs that we believe have the most innovation and the best chance of success forward, and we will probably take the ones with less chance of success and less innovation off the table.

Mr. Daily: Can you take us through the process of negotiations between the two companies?

Mr. Pyott: I suppose I have to say I was the bride, and here we are getting married. If we go back in history, Brent was CEO of Bausch + Lomb. He will speak for himself, but I know he is delighted to be coming home, as he describes it, to the world of ophthalmology. But we knew each other. We also serve, and served, together on the Foundation of the American Academy of Ophthalmology board. In fact, Brent stayed on that board even after he moved on from Bausch + Lomb to Forest Labs and, most recently, Actavis.

A couple of months ago, he reached out to me saying that he liked Allergan and our assets, was impressed by the growth of the company and its great growth outlook, and, if it made sense, he wanted to talk about a friendly merger as an alternative to what we were facing. At that time, we were still executing our plan to step up our performance, as we were determined to build value so that we might have remained independent. Then in more recent times, our side had to be concerned about whether we were going to win the vote at the then still programmed December 18 special stockholder meeting. [Editor's note: Valeant had scheduled a special meeting of Allergan shareholders for December 18, at which shareholders would have voted on whether or not to remove a majority of Allergan's board of directors in an attempt to clear a pathway to a hostile takeover.] Of course, at different price levels, I could have different views on the outcome. Maybe at $200 a share, Allergan stockholders might have voted for retaining six of our directors that they were attempting to remove. Maybe at $200 we would have won the vote. But at $219, the figure we settled on, that is the number I think probably even stockholders who really liked Allergan and its business model would have said, “That is a fair value. I am just going to take my money off the table.”

During the past couple of weeks, Brent and I started speaking more frequently in terms of what his views of an offer price would be and what we would expect. Then we started getting into a very, very narrow difference. I then agreed that we were willing to engage in a major session in due diligence with roughly 20 executives on our side and roughly 20 executives on the Actavis side. We chose to meet in the middle of the country, in Chicago, and spent several days together.

I was impressed by how professional and talented the Actavis team was. It was striking how we have similar company missions. We have a lot of the same values and pragmatic, roll-up-the-shirtsleeves, get-it-done cultures. I will leave it to Brent to describe his vision for the future. It clearly is not to become a big pharma company, although we will be a big company in this industry.

That is how we came together. The deal that we were negotiating needed to be, and was, overseen all the way through by the two boards of directors, then finally was approved unanimously by all the directors on both sides.

Mr. Daily: Brent, during the conference call with investors on November 17, you said that one of the attractive terms of the acquisition is that Actavis already operates in three of the four therapeutic areas that Allergan operates in. What about that fourth area that Actavis is not currently in, which is ophthalmology? What products in Allergan's ophthalmology portfolio are most appealing to you, and moving forward, where do you believe the biggest areas of growth lie in the ophthalmic space?

Mr. Saunders: That is like asking to pick a favorite child. I think Allergan's portfolio is incredibly exciting. When I look at drugs like Restasis [cyclosporine ophthalmic emulsion] that really created the market for dry eye and still leads the market for dry eye, Ozurdex [dexamethasone intravitreal implant] that has a diabetic macular edema indication now, and Lumigan [bimatoprost] and soon sustained-release Lumigan, it is exciting. They have a terrific and full portfolio of products, and I am just mentioning several. As you look into the future and think about next generations of Restasis and certainly DARPin [designed ankyrin repeat protein], it is exciting. Allergan is advancing care around AMD [age-related macular degeneration], and retina is going to be important to the future as well.

Mr. Daily: You mentioned DARPin for AMD and Lumigan for glaucoma. What will Actavis' approach be to ensure that these big products reach their full potential?

Mr. Saunders: I think it is to do exactly what Allergan has been doing. I think there is going to be little change. This is a well-oiled machine or, as David refers to it sometimes, a Formula One racecar. I fully concur with that. Our job is not to change things; our job is to keep challenging ourselves to get better every day. I do not think you are going to see a lot of changes in personnel or in our commitment to innovation and R&D.

Mr. Daily: In making its case for the takeover of Allergan, Valeant cited the shared treatment areas between the two companies in eye care, dermatology, and aesthetics. Valeant was also critical of the Allergan board of directors for not engaging more in discussions. What is your reaction to Valeant management's view that Allergan was doing its shareholders an injustice by refusing to engage in talks?

Mr. Pyott: I think one thing we learned quickly in this process is that a lot of actors express views purely out of self-serving and self-interested motives. When one looks back, the Allergan board of directors did an absolutely stellar job. They stuck together under all the criticisms, which were ill-founded. We have created an enormous amount of value. In fact, since the whole saga began, it is an enormous number: $30 billion dollars worth of stockholder value. That has probably never been done before. We had a positive article in the Wall Street Journal to that effect.

These words that are tossed out there about “entrenched” boards of directors; that is just a word that is useful for the attacking side to use. We did exactly the right thing by our stockholders, and I am pleased to say that the reaction, not only from the investment community, has been favorable to us on the Allergan side. I am enthusiastic about the vision that Brent has expressed on creating a growth pharma company—not a big pharma company, a growth pharma company.

For your readership, I think, encouraging has been the overwhelming positive feedback we have gotten from ophthalmologists worldwide. We had an open letter for ophthalmologists to express their views on what Allergan stood for. I think in less than 10 days we had almost 2,000 physicians signed on, of which about 1,000 were ophthalmologists.

I am well connected with the ophthalmic community, having now worked here for 18 years and having served on many different foundation boards. As an aside, I am president of the International Council of Ophthalmology Foundation—the first nonphysician ever. So many of these people I know sent me personal e-mails saying anything from “congratulations” to “I'm relieved that you're partnering with a company that is committed to R&D.”

Mr. Daily: This hostile takeover bid by Valeant dominated headlines over the past several months, and in a lot of ways, it was unprecedented. Looking back on this period, is there anything that you learned or anything that you would have done differently?

Mr. Pyott: I think that we can say in many ways, not just for ophthalmology but for the complete industry, this was unprecedented. Really, never before had an activist investor teamed up with a strategic company to try to pull off a transaction like this. Hence why there has been plenty of spice in it for just about everybody, from lawyers to journalists to people who post blogs. It has been full of interesting developments.

I think that the whole degree of rhetoric was, on certain days, pretty tough. I suppose what it shows is that our company is strong. With a talented board of directors, we were able to defend our rights. In essence, we prevented Valeant from stealing this company—a great company with a 64-year tradition—for a ridiculously low price.

Based on advice from Goldman Sachs, Bank of America, and Merrill Lynch, we felt when we finally entered the deal [with Actavis] that their number reflected the true value of this company. And, given the opportunities together, it still makes enormous sense for Actavis shareholders, because I know Brent is as diligent and considerate in terms of value creation as I am.

This [merger] is a true win-win, and as part of that, to reiterate what I said earlier, we were happy to take 41% of the consideration in Actavis stock, because we believe there is a great upside for Allergan stockholders who choose to remain stockholders when they receive the exchange into Actavis shares. It is not just a good deal on day 1; it is a great deal as we generate this upside in the coming years.

Mr. Daily: Brent, I want to give you the opportunity to talk about the new combined company. Just a couple of years ago, Actavis was primarily focused on generic drugs, and the company has since purchased Warner Chilcott and, in 2013, Forest Laboratories. With the blockbuster deal announced this week, Actavis by sales volume is now officially a big pharma company. In what ways will this quick growth change or affect the focus and strategy of the company?

Mr. Saunders: We do not think of ourselves as big pharma. I think David mentioned earlier our goal here was not to be big. Our goal was to be the best at what we do, to be leaders in every therapeutic area in which we operate, to have the best portfolio of products, to have the best people, to have the best innovation.

We coined a new phrase for what we believe our company is, which is growth pharma. We coined that because we believe there are only a few companies that are growing at the pace at which the new combined organization will grow in terms of revenue or sales. We think it is going to be a dynamic environment. We think it is going to be a place that will attract and develop the best talent and the place where we will continue to drive innovation for physicians and patients.

Mr. Daily: David, you said that your focus is going to be on ensuring that the transition is completed and that a successful transition takes place. What are your plans for the long term?

Mr. Pyott: I have been doing this for a long time. I would have retired at some point from being full-time CEO anyway after this transaction is closed. It is only day 5, so I'm still thinking about that. Clearly, one thing that would be of interest to readers is that I am committed to ophthalmic philanthropy. As stated earlier, both Brent and I serve on the Foundation of the American Academy of Ophthalmology advisory board, I am president of the ICO Foundation, and fortunately, I have made a lot of money even before this all happened. By pure chance, my brother is an ophthalmic cataract surgeon in Scotland. He built the first eye care hospital in Cambodia. He spent 7 years in Cambodia, so I have a lot of ideas about what I want to do for the advancement of eye care in some needy countries around the world. I know how eye care is delivered, and hopefully, I have some money now to put into such projects. That will definitely be part of what I am going to do. The rest … I still have not worked out.n