The 80/20 rule, or Pareto principle, holds that 80% of outcomes can be attributed to 20% of causes. In the context of pricing, this can be interpreted to mean that 80% of customers will be willing to pay lower prices and 20% of customers will be willing to pay significantly higher prices.

Applying the Principle

The Pareto principle is named after Italian economist Vilfredo Pareto, who observed that about 80% of the land in Italy was owned by about 20% of the population. The principle can be applied to many different things in nature. For example, about 20% of the individuals in a population of animals may be responsible for producing about 80% of the offspring. About 20% of the species in a forest ecosystem may be responsible for most of the biological diversity. In a human population, about 20% of the people own about 80% of the wealth.

The Pareto principle is not a strict rule but a general observation that often holds true. Oftentimes, the distribution is not exactly 80/20, but it is close. The principle can help identify and focus on the most critical factors in a situation to achieve the most significant impact.

PRICING REFRACTIVE SURGERY

One way to apply the Pareto principle to pricing is to offer a range of prices for your treatments, with lower prices for most patients (eg, LASIK) and higher prices for a select group of patients willing to pay more for additional features or benefits (eg, lens replacement or lenticule extraction). But, how much could you theoretically charge for a vision correction procedure if you could supply your patient with enough value to justify the price?

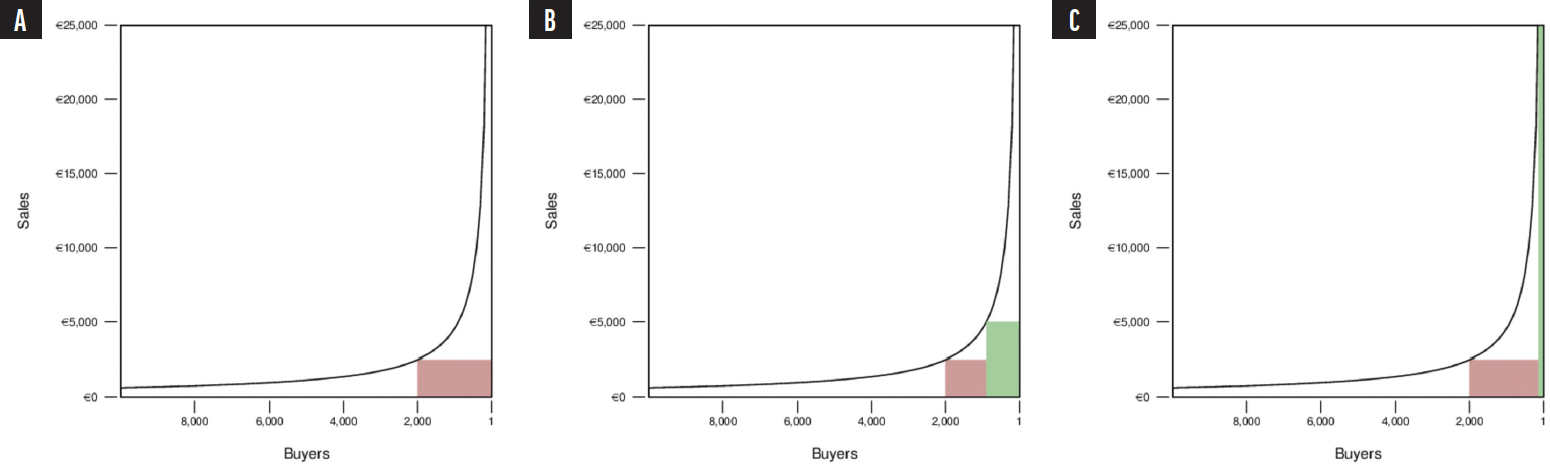

Let’s say that, in a population of 5,000 patients (10,000 eyes), 80% of buyers will pay for glasses and contact lenses and 20% will pay at least $2,650 per eye for surgical vision correction. In Figure A, a red rectangle indicates the group of eyes that underwent surgery. The area under the curve to the left of the red rectangle represents the volume of people who might pay less than your price for vision correction. For example, a practice that operates on 2,000 eyes at $2,650 per eye has a sales output of $5.3 million. This suggests that you may want to offer a treatment that appeals to those patients and provides similar results but with less convenience (eg, PRK).

Figure. The 80/20 rule in pricing. The red rectangle represents the group of eyes that underwent surgery (A). The green rectangle represents the volume of patients in the market who would be willing to pay double your price (B and C).

In contrast, the space within the curve above the red rectangle represents the volume of customers willing to pay more if you offer them greater value (Figures B and C). The green rectangle represents the volume of patients in the market who would be willing to pay double your price (2 x $2,650 per eye = $5,300 per eye). According to the Pareto principle, the predicted response for a price of $5,300 per eye is 894 eyes for a total sales output of $4.74 million. Hypothetically, your practice could charge $5,300 per eye for lens procedures and make almost as much as the LASIK/PRK practice with less than half the patient volume. Alternatively, you could use the chart in the Figure to predict how many people would be willing to pay for lens replacement or lenticule extraction eye procedures.

As an illustration, let’s push the limits of this hypothesis and multiply the price for vision correction by 10 and charge $26,300 per eye. According to the 80/20 principle, the predicted response for the price of $26,300 per eye is 138 eyes for a total sales output of $3,629,400 million. This suggests that you could treat 138 eyes and charge as much as $26,300 per eye if you could provide sufficient value. Does this sound absurd?

WHY PAY MORE?

Consider how Singapore Airlines uses the 80/20 principle. A round-trip economy flight from London to Singapore on an Airbus A380 currently costs $1,300. A first-class ticket on the same flight costs $13,250.

There are 14 first-class seats on the A380 plane, which is 2% of the total 647 seats. The remaining seats comprise 76 business class seats (12%) and 557 economy class seats (86%). Why do 2% of passengers pay more than 10 times the standard price for a first-class ticket and 86% pay for economy tickets on a return flight from London to Singapore with Singapore Airlines? There are several reasons.

Ultimately, the willingness to pay a higher price for a service will vary from patient to patient and may be influenced by a combination of the following and other factors.

Perceived value. Customers may be willing to pay more for a product or service if they believe it offers higher value or quality. For example, customers may be willing to pay more for a first-class plane ticket because it provides a more comfortable and enjoyable travel experience. As a refractive surgeon, you could treat a limited number of patients at any one time (eg, one patient every 2 hours) with your whole team tending to each patient’s every want and need.

Time. Customers may be willing to pay a premium for a product or service if it saves them time or helps them to be more efficient. First-class passengers always board and deplane first. They don’t wait in lines, and their luggage arrives first on the belt. In a medical practice, some patients may be willing to pay more for evening or weekend surgical appointments if doing so allows them to receive the benefits more quickly and does not interfere with their work schedules.

Convenience. Some customers may be willing to pay more for a product or service that is more convenient for them. For example, a patient may be willing to pay more if you book them a room at a 5-star hotel close to the practice with luxury travel to and from the practice for every visit included in the package.

Status. Some customers may be willing to pay more for a product or service to signal their status or success. For example, a patient may be willing to pay more for medical services offered by a London Harley Street practice where a celebrity surgeon who appears on TV treats a relatively small number of high–net-worth individuals (including celebrities) and their families.

A GENERAL PRINCIPLE

This exercise is not a suggestion to charge 10 times what you currently charge for vision correction, although some of you could. Rather, the point is to show that if you’re not offering services that provide two to 10 times the value that you currently offer your patients and charging them accordingly, then you’re likely leaving some money on the table.

Remember that the 80/20 rule is a general principle and may not hold true in all situations. Carefully consider your target market and the value of your products or services to determine your practice’s most appropriate pricing strategy.