We are often asked how to cut practice costs, which is a roundabout way of asking how to improve practice profitability. It’s important to realize that profit enhancement is much more a matter of revenue enhancement than cost containment. When considering prospective cost containment opportunities, always look at the largest categories first: the cost of lay support staffing, the cost of facilities, and the cost of marketing. In almost all settings, these three categories cover the majority of a practice’s operating costs.

Containing costs by improving the productivity of lay staff is a little bit like practicing medicine. It is best to look at the bigger, subjective picture before getting more granular.

Lay Support Staff Costs

When you look down the hallway in the clinic, do a lot of people appear to be standing around, or does it look like everyone is purposefully engaged? You certainly don’t want them to be frantic throughout the day, but in a typical clinic running a typical schedule, people should be working at a good pace in turns throughout the day. In the past, most medical practices guaranteed full-time employment to lay staff. More recently, medical practices are increasingly taking an approach similar to that of restaurants—if it’s a quiet day, they start calling off staff and sending them home. Consider adopting this approach if you find a surplus of staff on the clock and a shortage of work to be done.

A typical ophthalmology practice spends about 30 cents of every dollar collected on lay staffing in burdened wages, taxes, and benefits. Although location plays a role (see Average Practice Labor Costs), the most important factor influencing how much a practice spends on lay staff is the effectiveness of the management team. When we see a practice that appears to be overstaffed or spending too much on labor, we look first to see if any suboptimal staffing approaches are being taken by midlevel managers or the practice administrator.

Average Practice Labor Costs

The standard guideline for how much to spend on lay staffing changes depends on where the practice is located. It may be perfectly reasonable for an ophthalmology practice in an expensive urban setting to spend 35% of cash flow on lay staffing and for a practice in a rural setting to spend only 25% on lay staff.

To examine lay staffing costs, determine how many lay staff hours are used per patient visit. A patient visit is when the patient is there to see a provider, whether for a paid examination, a pre- or postoperative visit, or something else; technician-only visits do not fall under the category of a patient visit. In a general ophthalmology practice, we see about 2.5 lay staff hours per patient visit. For tips on addressing the problem of excess staff, see How to Mitigate an Overstaffing Problem.

How to Mitigate an Overstaffing Problem

If you examine the gross measurements of labor productivity and find that your practice is overstaffed, here are two options you can try.

- Reduce hours or staff. Reduce the hours that people work each week. Instead of guaranteeing 40 hours, if you only need people 32 hours a week or less, reduce the hours that you’re paying for. Alternatively, reduce the total head count of lay staff in the practice. Instead of trimming hours, identify and lay off one or more staff members who are extraneous or underperforming.

- Increase patient volume. Another option to balance volume with capacity is to build patient volumes. If you determine that you have excess hours per patient visit and a backlog of patients who need appointments, you may prefer to see more patients every week rather than reduce staffing.

Granular Evaluation of Lay Support Staff Costs

Turning from this gross approach to lay staff labor productivity, you can get more granular by evaluating each department.

Technicians. You can evaluate technician hours per patient visit. In the typical general practice, there is about 1 technician payroll hour per patient visit. That includes working up patients, scribing, doing special testing, and assisting during injections and minor procedures.

Reception. In our experience, about 0.5 reception payroll hours are typically required per patient visit. The convention for determining payroll hours per patient visit for reception staff is to take the hours of any staff members who answer the phone, make outbound calls for appointment reminders, or assist with the check-in or check-out process—any employee working at the front side of the practice—and divide that by the number of patient visits. Ideally, this amounts to about 0.5 hours. Another way of thinking about this is that it takes about 30 minutes of staff time to check a patient in, check a patient out, make a patient’s next appointment, remind a patient of an appointment, pull and refile the chart if paper charts are being used, etc.

Billing. The typical practice—regardless of subspecialty—uses about 0.3 billing staff hours per transaction. Note that the terms change here; instead of per patient visit, it’s per transaction, so the denominator is not patient visits alone but also surgical cases. If a practice has 500 patient visits and 50 cataract surgeries, the dominator is 550. Dividing the monthly billing staff, including supervisors, hours spent accomplishing the whole arc of revenue cycle management gives you the billing staff hours per transaction, which typically is 18 minutes.

Surgical scheduling. After a patient sees the doctor, the surgical scheduler explains to the patient how the entire surgical journey will work. Sometimes, the surgical scheduler assists in choosing the appropriate lens, and this person will be on call for the patient before and after surgery. In a typical practice, about 2 to 2.5 hours of surgical scheduler time is required per case (eye).

Optical. You want to see about $200,000 or more in annual collections for a full-time optician. For example, if you have three full-time positions in your dispensary, you want to see $600,000 or more in annual collections. If yours is a smaller practice, emphasize increasing profits and aim for long-term longevity among staff members. It can be challenging to lose even a single staff member in a small practice, so you want to recruit steadily and, if possible, provide cross-training. Larger practices are less affected by departing staff.

Facility Costs

Staffing can be increased or reduced on a short timeline, but facility costs tend to be more challenging to adjust. The norms for facility costs as a percentage of practice collections is about 4% to 6% of those collections. It can be twice this amount if you’re using a building that your practice is still growing into or if you’re in an urban location where lease rates are high. It can be half of that figure in a rural setting, with just 2% to 3% of cashflow spent on facilities. Rural office space is far less expensive in relation to the cash flow of the practice.

Negotiate. Negotiating is the key component of adjusting facility costs. You’ve got one big vendor who’s selling you one big item of your operating budget—your facilities—with a typical contract cycle that lasts at least 3 years. When the window to negotiate opens, therefore, it is important for you to be prepared to negotiate the best deal you can.

Reduce space. Another option is to give up space. Several of our clients have successfully compressed their facility needs through negotiation with their landlord. This can sometimes be done midcycle and is an option at the end of the lease cycle.

Share space. A third option is to share the space you have with others. Suppose you have a general ophthalmology practice that does not provide retina or oculoplastic services. In that case, you can bring in those service providers to support a portion of facility costs.

Relocation. You can also relocate to reduce facility costs. For example, maybe your practice does not fit the mold of a main street kind of facility. Premium spaces are costly. You may be able to move somewhere less visible (and less expensive) in the future.

Marketing Costs

Marketing typically consumes about 1% to 6% or more of every dollar a practice collects. Marketing costs are higher in refractive and cosmetic plastics practices, and they are much lower in retina, glaucoma, and pediatric practices, which are almost purely referral-based.

Whether it’s during a recession or a pandemic, many practices cut marketing costs rather than let staff go or reduce facility costs. In our experience, however, clients who take this approach to cost-cutting often require much longer to come back and lose more in the long run compared to what was saved from cutting the marketing budget.

Vendor Costs

It is important to do a vendor review annually. We recommend using a three-column tool for this assessment. The name of the vendor should go in the first column. In the second column, rank the vendor on a scale of zero to 10, where zero represents poor value for the money paid and 10 represents exceptional service. The last column is the action needed. If you rank a vendor a nine or a 10, the necessary action may be to praise them for doing a great job. If you are unhappy about the quality or the value of a vendor, it may be time either to negotiate harder or to admonish them to get back on track. The necessary action in the third column may be to replace a vendor who is not meeting your expectations.

Improving Overall Profits

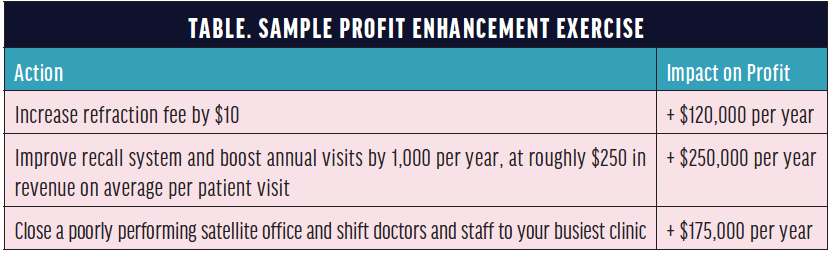

Another column exercise focuses on improving practice profits overall—not just cost containment but also profit enhancement through some combination of revenue enhancement and cost reduction. The exercise involves making 2 columns on a sheet (see the Table for an example).

Other examples of profit enhancement include simply seeing a few more patients per day and using your recall systems more avidly. Adding three patients to a doctor’s schedule increases profits by about $100,000 per year in the average clinic. Regarding recall, in the typical practice we audit, 20% to 30% of patient encounters do not have appropriate, effective recall continuity care measures, and these patients slip away. That’s not great in terms of economics, clinical quality of care, or risk management.

Surgeon assertiveness plays a role here, too. A practice where patients’ average preoperative BCVA is 20/60 or 20/70 versus 20/50 performs more surgery.

Passive Profit Enhancement

Options for passive profit enhancement include adding an ambulatory surgery center (ASC), an optical service, or employee providers.

ASC. Adding an ASC or purchasing a portion of one can boost the profit per cataract case by $200 to $300 and essentially double net income per cataract surgery.

Optical. Adding an optical service or improving an existing one can add about $10 in profit per patient visit in a typical practice.

Employee providers. Adding just one optometrist can increase a solo practitioner’s profits by $100,000 or more annually. Additionally, transferring patients to a colleague when they no longer need to see you makes your time in the clinic much more efficient and allows you to handle more professionally interesting visits.

Conclusion

Cost-containment and revenue-enhancement opportunities are present in almost all practices, even the best-run ones. In the typical practice we take on as a client, we find $50,000 to $100,000 or more in missing profits per provider, and it doesn’t take heroic efforts to capture that incremental profit. Apply these ideas where your practice can use them.