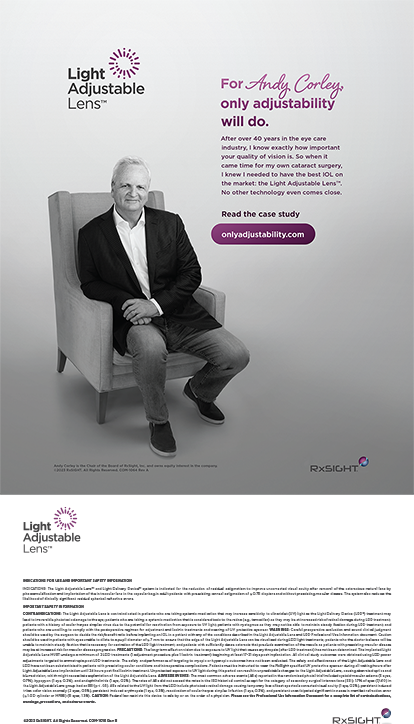

After years of stagnant numbers, the market penetration of presbyopia-correcting IOLs slowly increased over the past 2 years as new designs entered the market.1 Presbyopia-correcting and presbyopia-correcting toric IOLs and nonpresbyopia-correcting toric IOLs accounted for 7.6% and 7.9%, respectively (total 15.5%), of the total number of IOLs implanted in Q4 2019—the last quarter before the COVID-19 pandemic began—compared to 10.6% and 7.9%, respectively (18.5% total), in Q3 2021 (Figure 1).1 This article examines the upward trend and factors that might have contributed to it.

Figure 1. Market share for premium IOLs (abbreviation: PC-IOLs, presbyopia-correcting IOLs). Source: Market Scope.1

OBSTACLES

Presbyopia-correcting IOLs. Based on the results of the annual ASCRS survey, the market penetration of presbyopia-correcting IOLs has ranged from 8% to 10% for the past several years.2 If these lenses are better and offer more to patients than standard monofocal IOLs, why isn’t every surgeon placing presbyopia-correcting IOLs in every patient who is a good candidate?

Toric IOLs. Astigmatism affects nearly half of the 24.4 million cataract surgery patients in the United States.3 It, however, often is not treated during cataract surgery. Compared to corneal incisional techniques, toric IOLs can more predictably correct astigmatism. Further, excellent UCVA can be achieved with these lenses.4 Approximately 20% of respondents to the 2019 ASCRS survey reported implanting toric IOLs in 40% or more of their cataract surgery cases, 28% implanted torics in 21% to 40% of their cataract surgery cases, and 52% implanted these lenses in 20% or fewer of their cases.2 Considering that approximately 50% of the US population has at least 0.75 D astigmatism, one would expect the market penetration of toric IOLs to be much higher.3

The reasons. Two reasons for the limited market penetration of presbyopia-correcting and toric IOLs are surgeon confidence in the technology and past and current technological limitations. With presbyopia-correcting IOLs, limitations include optical trade-offs (ie, positive and negative dysphotopsias) and quality-of-vision concerns. Splitting incoming rays of light to achieve multifocality entails a degree of compromise. With toric IOLs, surgeons have concerns about how to ensure proper orientation both during and after surgery. Studies of rotational stability have shown that the incidence of unwanted rotation of a toric IOL during the immediate postoperative period occurs in a small percentage of cases.5,6

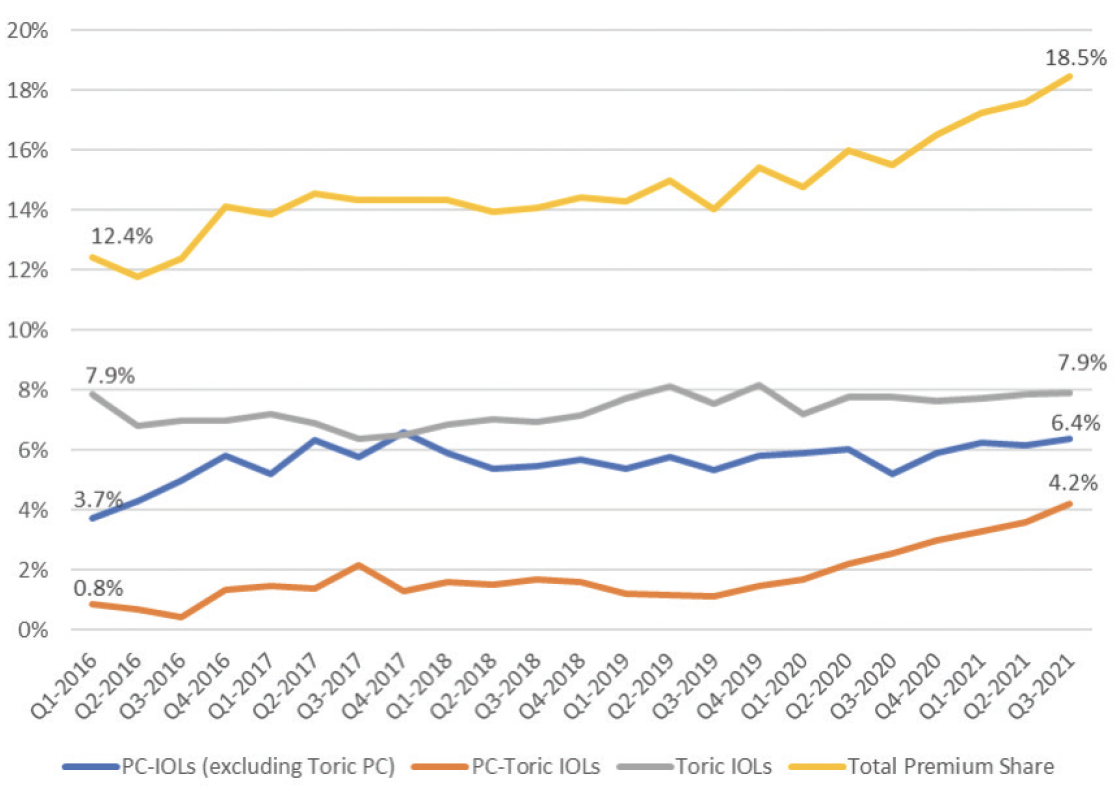

Recent advances in optical and structural IOL design, however, have reduced the compromises and trade-offs associated with presbyopia-correcting IOLs, and manufacturing improvements have increased the rotational stability of toric IOLs. For example, the Tecnis Toric II IOL (Johnson & Johnson Vision), released in 2019, features frosted haptics (Figure 2). Research showed that frosting the haptics to make them tackier within the capsular bag reduced the small incidence of early postoperative rotation.7 Another example is the introduction of spherical and toric models of several presbyopia-correcting IOLs, which give surgeons and their patients more options.

Figure 2. The frosted haptic edge of the Tecnis Toric II IOL.

IOLS SPURRING CHANGE

The recent release of four products is changing the US marketplace.

No. 1: AcrySof IQ PanOptix IOL (Alcon). This IOL (Figure 3), approved by the FDA in September 2019, is the first and only trifocal diffractive IOL on the US market. A toric model is also available. Extensive European experience with the PanOptix helped fuel its use in the United States, and this family of lenses has quickly gained US market share from other available presbyopia-correcting IOLs.

Figure 3. AcrySof IQ PanOptix Toric IOL.

It should be noted that there are optical limitations with all diffractive lens technologies and that careful patient selection remains important to the successful use of any presbyopia-correcting IOL. That said, the PanOptix can provide high levels of spectacle freedom and patient satisfaction as well as a high quality of vision at distance, intermediate, and near.8,9

No. 2: AcrySof IQ Vivity IOL (Alcon). The Vivity was approved for use in the United States in February 2020 and was the first extended depth of focus (EDOF) IOL in this market. A toric version is available as well. EDOF IOLs can avoid issues with quality of vision that are associated with multifocality while providing patients with distance and intermediate vision. The range of vision at near with EDOF IOLs, however, is somewhat limited, and certain patients either must wear spectacles for near tasks or require a blended vision (ie, mini-monovision) strategy to increase their independence from spectacles.

No. 3: Clareon IOL (Alcon). This aspheric monofocal and corresponding toric IOL (Figure 4A) received premarket approval from the FDA in January 2021. Both models are made of a novel hydrophobic acrylic material that replaced the AcrySof material used by the company since 1994. The change was prompted by concerns about glistenings, which can reduce the modulation transfer function of an IOL and thus the patient’s contrast sensitivity.10 Alcon simultaneously introduced an automated, disposable, preloaded injection system (AutonoMe) that can deliver IOLs in a precisely controlled fashion (Figure 4B).

Figure 4. Clareon aspheric IOL (A) and AutonoMe Injector System (B) for smooth, well-controlled release of the IOL.

Figures 3 and 4 courtesy of Alcon

No. 4. Tecnis Synergy (Johnson & Johnson Vision). Both the nontoric Tecnis Synergy and the toric Tecnis Synergy Toric II received FDA approval in April 2021, representing the first hybrid trifocal/EDOF technology available in the United States (Figure 5). The rollout of these IOLs has been slow, but they can provide excellent visual outcomes and a high degree of spectacle freedom.11

Figure 5. Tecnis Synergy Toric II IOL.

Figures 2 and 5 courtesy of Johnson & Johnson Vision

CONCLUSION

The additions to the US cataract surgery marketplace discussed here have helped increase surgeon confidence, which is ultimately the underlying limitation to increasing penetration of advanced IOLs in the US marketplace. One hopes that this is just the beginning of an exciting trend leading into 2022.

1. Market Scope 2021.

2. ASCRS Clinical Survey. Highlights of the 2019 ASCRS clinical survey. ASCRS. Accessed January 10, 2021. https://supplements.eyeworld.org/eyeworld-supplements/ascrs-clinical-survey-2019

3. Vitale S, Ellwein L, Cotch MF, Ferris FL 3rd, Sperduto R. Prevalence of refractive error in the United States, 1999-2004. Arch Ophthalmol. 2008;126(8):1111-1119.

4. Kessel L, Andresen J, Tendal B, Erngaard D, Flesner P, Hjortdal J. Toric intraocular lenses in the correction of astigmatism during cataract surgery: a systematic review and meta-analysis. Ophthalmology. 2016;123(2):275-286.

5. Li S, Li X, He S, et al. Early postoperative rotational stability and its related factors of a single-piece acrylic toric intraocular lens. Eye (Lond). 2020;34(3):474-479.

6. Lee BS, Onishi AC, Chang DF. Comparison of rotational stability and repositioning rates of 2 presbyopia-correcting and 2 monofocal toric intraocular lenses. J Cataract Refract Surg. 2021;47(5):622-626.

7. Takaku R, Nakano S, Iida M, Oshika T. Influence of frosted haptics on rotational stability of toric intraocular lenses. Sci Rep. 2021;11(1):15099.

8. Lawless M, Hodge C, Reich J, et al. Visual and refractive outcomes following implantation of a new trifocal intraocular lens. Eye Vision (Lond). 2017;4:10.

9. Sudhir RR, Dey A, Bhattacharrya S, Bahulayan A. AcrySof IQ PanOptix intraocular lens versus extended depth of focus intraocular lens and trifocal intraocular lens: a clinical overview. Asia Pac J Ophthalmol (Phila). 2019;8(4):335-349.

10. Stanojcic N, O’Brart DPS, Maycock N, Hull CC. Effects of intraocular lens glistenings on visual function: a prospective study and presentation of a new glistenings grading methodology. BMJ Open Ophthalmol. 2019;4(1):e000266.

11. Ribeiro FJ, Ferreira TB, Silva D, Matos AC, Gaspar S. Visual outcomes and patient satisfaction after implantation of a presbyopia-correcting intraocular lens that combines extended depth-of-focus and multifocal profiles. J Cataract Refract Surg. 2021;47(11):1448-1453.