Five years ago, the centuries-old pen-and-paper method of documenting, drawing, and illustrating medical information was rapidly changing to computer-based files. Practices were going through the agonizing steps of converting to electronic medical records (EMR). Offices had to close for a few days during the initial training. Physicians had to decrease the volume of patients seen during the launch. Delays in processing led to dissatisfied patients. Costs and stress were high.

Now that the blood, sweat, and tears are done, what have practices gained?

DATA MINING

Finally, physicians can start mining their own treasure troves of data to better serve current patients and find new business. Several companies have burst onto the scene to offer such services. Most of them work with the practice management team and/or surgeon to form a hypothesis. Each using its own process, these companies identify and cull data from the EMR system and then employ data science and analytics to uncover opportunities for immediate impact. For example, one can search patients with a specific diagnosis or by age for a new procedure incorporated within a practice. When we purchased our LipiFlow unit (TearScience), we were able to do a targeted e-blast to all patients with a diagnosis of dry eye disease. Once consensus has been reached by the management team or by the physicians as to what parameters to explore, a company begins the automation phase. The goals are operationalized and “set to forget,” meaning that no additional work is required. Following are examples of four companies that offer different types of data- mining services.

AT A GLANCE

• Now that electronic health records are in place, physicians can use data mining to better serve current patients and find new business.

• Several companies offer data mining services that help practices benchmark outcomes, identify patients who are good candidates for premium services, track lost patients, and customize reports.

• Data mining companies usually charge a flat fee for the initial project, followed by value-based pricing that incorporates a percentage of the new revenue generated to a defined maximum or an agreed-upon monthly subscription.

MARKET SCOPE

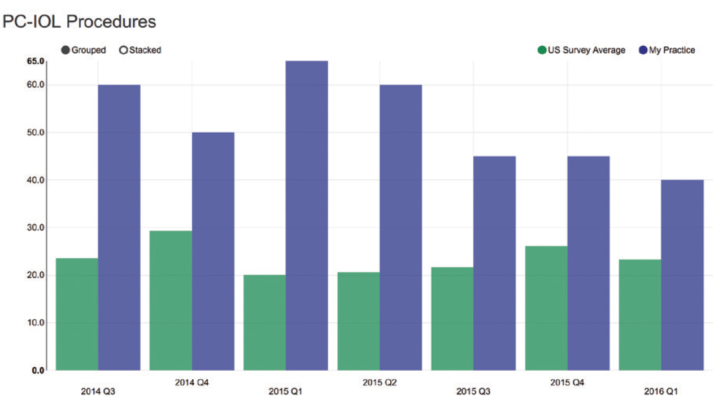

An annual subscription to this service offers an interactive data dashboard with which to compare practice metrics to aggregate results. It allows benchmarking of surgical volume and conversion rates with nicely illustrated graphs for easy interpretation at a glance (Figure). The service covers all subspecialties, including cataract, refractive, glaucoma, and retina.

CONCLUSN

Conclusn uses data science and analytics to increase conversions to premium lens implants or other cash-pay services. The service identifies customers’ “hidden wants and wishes” as well as the customers and prospects on whom a practice should place greater focus. The company then helps operationalize and automate the generation of new insights to improve the bottom line of the practice.

BREVIUM

By looking at historical data, Brevium estimates that less than 50% of patients respond to recalls. Furthermore, many of them cancel appointments, do not show up for scheduled visits, or fail to make their next appointment as they check out.

Figure. Market Scope’s benchmarking graph.

Brevium automatically searches every patient’s history nightly to identify who has been lost based on criteria selected by the practice. The company’s technology mines the recall, visit history, and claims data in a practice management system database. First, it analyzes ignored recalls to find patients who missed or never scheduled an appointment after receiving a reminder. Then, it analyzes claims data to identify patients with diseases such as glaucoma, diabetes, macular degeneration, or cataracts who are overdue for a visit, even if no recall was ever entered. Patients are targeted based on identified disease states and customized care intervals.

Either one of the practice’s staff members then calls patients, or Brevium’s partner company makes the calls for an additional fee. Regardless, through automated platforms, statistical reports are readily generated to document outcomes and procedural success.

MOORE SOLUTIONS AND EYE CARE LEADERS

Every electronic management system brags about the myriad types of reports it offers to clients so that they can better evaluate their cash stream or patient analytics. Unfortunately, these reports are often difficult to run and are not customizable. Companies such as Moore Solutions and Eye Care Leaders have found a way to work around inflexible reporting systems. They go into the server “through the back” and access raw data. Using sophisticated pivot systems, they create any customized report the client desires. Of course, fees are associated with each report. Moreover, it takes collaboration and effort to create the bridge between the company and the practice’s electronic health records system. Often, the EMR companies set daunting and unrealistic hurdles that one has to overcome to create these interfaces.

COSTS

All of the services discussed come with a price tag. Usually, there is a flat fee for the initial project, followed by value-based pricing that incorporates a percentage of the new revenue generated to a defined maximum or an agreed-upon monthly subscription.

Data mining can lead to improved quality of care and increased practice revenue. The process is all about rapidly delivering high value to clients by mining their own precious materials.