Alan E. Reider, JD, MPH: This roundtable discussion deals with the entrance of private equity into the ophthalmology space. Consolidation of medical practices and centralized management are not a new phenomenon. Some specialties, particularly oncology, anesthesiology, and more recently, dermatology, have been operating under this model for many years. In fact, in the 1990s, ophthalmology was in the midst of the physician practice management company (PPMC) phenomenon, where many companies—PRG, Prime Vision, Vision 21, TLC, and NovaMed, among others—were actively pursuing practices with the promise of greater operational efficiency and higher return for the owners. But, shortly after it began, the PPMC market in ophthalmology crashed and burned.

Now, we see a similar trend with private equity emerging with similar promises of greater operational efficiency and higher returns. But somehow, it feels different this time. Part of the reason may be based on the uncertainty of the future of the Medicare and other governmental health care programs as well as the threats presented by commercial payers that are restricting participation on their provider panels. Practices are concerned about patient access, and many believe that they are better served by aligning themselves with a larger network that can more effectively compete for these contracts. In addition, there is increased concern about the crushing regulatory burdens of operating a medical practice. Physicians complain that they are spending more time on administrative issues than they are practicing medicine. Finally, the message from the private equity industry seems to be a bit different than the message 25 years ago from the PPMCs. This is not a leveraged financial play. Although certainly there is the hope that there will be some financial benefit, instead, this time, the private equity firms seem to be committed to working with ophthalmology to build a better delivery system with a focus on both the cost and revenue side so that the incentives of both parties are aligned. Whether it will work this time remains to be seen.

The purpose of this roundtable is to bring in some of the professionals who lived through the PPMC experience and know what went wrong. We hope to learn from them the mistakes that were made so that a practice that is considering private equity today can take steps to avoid those same problems going forward. I’d like to introduce each of the members of the panel and ask that they provide a brief background on what they’re doing today, what they did back in the 1990s, and their relationship with physician practice management (PPM).

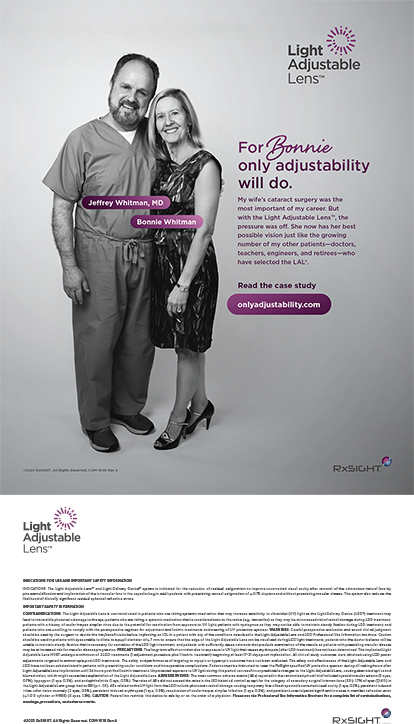

Jeffrey Whitman, MD: I have a practice in Dallas, the Key-Whitman Eye Center. Back in the 1990s, our practice got involved with PRG, largely because of what I would term safety in numbers. At the time, we thought that managed care was going to take over the world and either you were going to be in or you were going to be out. We wanted to be in. What made sense at the time didn’t work out in terms of efficiency or increased income, and eventually, like many others, we bought our way out of that.

Today, we’re in a large private group practice. We have between six and seven ODs and MDs, six offices, and a surgery center. We recently completed a new building for both our headquarters clinic and our main surgery center. There are partners in the surgery center, some that are part of our office and some that are outside our clinic. They’re not partners in Key-Whitman. I think that we will again look at safety in numbers. We’ll take a look at private equity; we’ve started that inquiry already. One [reason] has to do with the way the economy and insurance companies and Medicare are affecting our economy within the payment system in ophthalmology, and part of it is also looking ahead at what private equity is willing to pay upfront.

Bruce Maller: I am the president of BSM Consulting. We have a team of just under 50 people, and we provide a range of consulting services in the ophthalmic space, ranging from operational to strategic support. Back in the 1990s, our firm was a consultant to Vision 21, and I was on the board of directors of Vision 21 until they went through a restructuring. As part of that restructuring, I ended up taking an interim position as the chief executive officer of Vision 21, primarily to wind down the company, [to] assist in restructuring the company’s debt, and to sell back to the physicians their practices.

Dan Chambers: Currently, I am the executive director of the Key-Whitman Eye Center. Actually, Key-Whitman was a member of the PRG regime back in the 90s, and we [have] bought a number of other clinics and surgery centers that were associated with PRG since that time. Back in the 90s, I was actually the senior vice president of PRG, basically over operations. At the time, we had 140 practices in 26 states. We had 600 physicians, MDs and ODs, and 40 surgery centers at the time we dissolved and were in the process of restructuring.

Trent Roark: I was one of the founders of what became NovaMed and served as vice president of operations. Today, I am the CEO of Specialty Eye Institute. We have a number of practices stretching across Michigan, from Ann Arbor to Kalamazoo, north to Lansing, south to Adrian, and including Toledo and Bryan, Ohio. We’re a multispecialty ophthalmology practice providing laser cataract surgery, glaucoma, general ophthalmology, refractive surgery, and retinal care.

What went wrong?

Reider: Let’s start with the most fundamental question here: Why did the PPM industry fail for ophthalmology when it appears that it did not fail for others such as oncology and anesthesiology?

Whitman: I believe it did not offer economy of scale, so there wasn’t increased efficiency. We weren’t saving money in what we were doing, and we didn’t really have good direct contact with how much we were even making. So, financially, it wasn’t advantageous to us. Because you’re going through a large system, it was very difficult to add a practice to your existing clinic. We found there was not any economy developed by having a network of closely spaced practices that could work with each other and thereby, hopefully, save money and work on increased contracting for patients. So, it was really a matter of efficiency. It didn’t make us more efficient. It didn’t provide us with more patients.

Reider: Effectively, the promises weren’t kept. They weren’t able to deliver.

Whitman: Exactly.

Maller: As I reflect upon that time, there was a big gap between the “promise” and the ability to execute a sound business plan and to operate the companies in a disciplined and effective manner. This ultimately comes back to the failure of the leadership. In addition, I also think that most of the companies lacked a strong capital structure. Many of these companies struggled to invest in the proper infrastructure to be able to deliver on the promise. I think part of that was exacerbated by the desire to grow at too rapid a pace. I believe this was the case with Vision 21. They grew through acquisition, they grew too rapidly, and they really took their eye off the ball in terms of being able to execute their business plan. To Jeff’s point, they ultimately didn’t deliver on the promise.

One last comment I would make is [that] there was too much emphasis at that time on casing the potential for an IPO [initial public offering]. Once again, the focus needed to be on building a great company, not taking the company public.

Reider: Dan and Trent, you were both right in the middle of the operations. What’s your perspective on why they failed?

Chambers: As Dr. Whitman said, the primary driver was the fear of managed care and not having access to patients and the ability to negotiate more effectively as a group. Probably one of the more interesting things [is that] it was actually illegal to negotiate price across the individual professional associations, or professional corporations, simply due to the Federal Trade Commission regulations on price fixing. We didn’t really know that at the beginning. [Moreover] just because PRG owned the assets of the practices, they really did not own the individual physician practice, and as such, we really couldn’t negotiate pricing between different groups. We eventually formed several individual physician associations, but they were relatively weak, as the managed care pressures dissipated somewhat during the 90s.

The other thing is that the money that was being paid by Medicare and the insured actually belonged to the physicians themselves and not to [the] PPMC corporation. Therefore, the corporation didn’t really have any control of the incoming money, and the doctors figured out they had control of the money. So, when you’re dealing with doctors, it’s a little like herding cats. At the time, everybody wanted to be the boss. So, it was kind of challenging to effectively work as a group.

As Bruce said, PRG was really an acquisition company, and they acquired not only the original founding practices of PRG but also other corporations like EyeCorp, Equivision, and American Ophthalmic out of Orlando [Florida]. Now, this “roll-up” concept, from a capital structure perspective, didn’t really have any initial infrastructure, didn’t have any strong accounting ability nor any [information technology] capabilities, but actually added a lot of debt owed to physicians at the time. They didn’t bring any major cost-saving advantages, but we were a public company as a brand-new organization.

I can attest that buying a collection of practices really offers no synergy whatsoever when you’re buying them all over the country, and that may now be an unlikely approach by a private equity company today. Taking 35% of the doctor’s income was unacceptable for many. Basically, it lowered a lot of the competitive physician wages. It was an exit strategy for many senior doctors, and really, you often saw their individual production drop by 20% after an acquisition. In addition, when we acquired practices, most of them were essentially noncompliant with respect to coding, regulations, overtime, and other federal labor laws. Therefore, when we implemented appropriate compliance actions, they simply increased expenses for the practice. Finally, the mandatory accrual accounting methodology for many practices was extremely difficult to understand by doctors, which led to mistrust. Generally, more practices looked financially worse when they were converted to an accrual accounting system.

Probably one of the most significant elements that I dealt with was the issue that there was no rational succession value beyond the selling physician. Therefore, it was one and done for a lot of the senior doctors, who basically sold out and left no future value for the younger physicians. Also, being a public corporation, you are very different than private equity in the sense that a public corporation needs to disclose negative issues to the public domain with quarterly reporting, [whereas] private equity can keep those things quiet. So, given all of those issues happening in a short span of a few years, it led to a collapse of the industry.

Roark: I’m going to go back to something Dr. Whitman said, and that is economies of scale. That was the first emphasis when looking at the practices. What we quickly learned was that, the practices we acquired, the doctors were entrepreneurial. So, if you bring in a group of practices together and say, we want to standardize the way we do things, you’re going to find that it doesn’t work overnight. It takes a lot of time, and it’s very expensive to accomplish. The second thing you learn is that some things in a particular market are done a certain way because it is the most efficient way to do it. Stepping back and learning from these practices was very important.

Another lesson learned was that people don’t work as hard for others as they do for themselves. That’s not to point at any particular side of the equation, but the whole emphasis was let’s get this going, let’s show some growth, and let’s take this thing to the IPO level. It became a real push. Consequently, I think we had some misalignment of the motivation of the doctor and the corporation. In the earlier cases, doctors would get more of the money upfront. As we continued to grow, more and more people would get some stock and less money. The goal was to drive the value of the stock, and I think that kind of hurt us in trying to pull things together.

Finally, at the time, the big emphasis, as was mentioned earlier, was on managed care. That was going to be another value added that the management company brought to the table. Acquisition of practices in the same market would create a market [that] allowed us to be attractive for managed care contracts. What we found out was there really wasn’t a demand for ophthalmic managed care, and it was hard to get those contracts.

Reider: There are a couple of key points that I picked up. One was the fact that the PPMCs really didn’t create any efficiencies, and frankly, that was their key offering. We’re going to operate more efficiently, so we’re going to be more profitable. That didn’t happen. I also heard most of the panel members talk about a lack of synergy, and perhaps part of it was the fact that the model was flawed, because instead of getting practices all within a certain geographic area, they were dispersed all over the country. It’s very difficult to get synergy when you’ve got multiple practices in different places.

It sounds like they didn’t do their homework. For example, Dan’s comment that there was a lack of understanding that competing practices couldn’t set prices together reflects a fundamental misunderstanding of the industry and the regulatory environment.

Will the private equity sector avoid those problems?

Chambers: There’s a very different market and a lot different situations that are occurring today. A lot of the private equity due diligence effort is trying to find out what failed in the 90s. Keep in mind that, in the 90s, the intent in the acquisition of practices was for [the] long term. Today, the intent for private equity is short term, and that’s often 5 years or even less. As such, they have a timetable on return on investment, so they want to maximize their value within a 5-year period to sell to the next group.

Generally speaking, most of the private equity firms are looking for a platform practice with an ambulatory surgery center [ASC], and they look to “bolt” on additional practices for economy and synergy. I think they’re forcing that direction with available capital, financial control, and the type of governance approach that they’re taking. In PRG days, you had more power given to the individual practices, and they really didn’t work together. They really didn’t have an incentive to work together. That’s very different today with a private equity approach. So, I think you’re seeing more enforced control with private equity. We also see a different capital structure [that] they are willing to pay and invest in what it takes to add local practice acquisitions, new service, and equipment to become profitable, whereas in PRG acquisition days, the money was going out mostly to just buy practices; it really wasn’t to develop the infrastructure.

Reider: Trent, you happen to have been affiliated with the one [PPM] entity that survived, NovaMed, although it’s a little different [now]. Are there any lessons to be learned from NovaMed’s survival?

Roark: I think one reason we survived was we went from the PPM model practice management to an ASC management company. One reason that change became more valuable is because it’s the traditional model where the physician either has to go to the hospital to do surgery or to the ASC. As a result, we were not stumbling over a culture that was created by the physician in a practice. You have many specialty users of the ASC, generally speaking, so it was a little easier to make the changes to implement economies of scale in the ASC.

We also have to look at what’s different about the environment this time versus what it was back in the PPM industry. Again, back in the PPM, we were all concerned that managed care was going to create winners and losers by controlling patient direction. Today, we’re looking at a whole different set of issues. One of them is certainly management because of the increased regulations. The need to have some top management who can take that risk and that problem off the plate for the doctor is, I think, a powerful play. I think the other thing is that we have a different type of physician coming out of school today with a more balanced lifestyle goal. This is not necessarily bad, but they are not going to sacrifice time with their family or other interests to worry about the management of the practice. From this perspective, I think the renewed interest in management companies may be of interest to the younger doctor.

How should practices assess private equity firms?

Reider: What should practices be looking at in private equity?

Maller: The principal advice I would give is that you’re looking for a partner that is interested in working with you to build a great business. In the end, that will trump everything. If you have a great organization that you’ve developed, and you’re using the financial partner to help to fuel and develop your infrastructure as a platform to grow and, in turn, build and create efficiencies, that’s what you should be looking for. What you’re looking for is really the ingredients of leadership for people that can come to the table, complement a great physician and administrative leadership team, to help build a business plan that’s really going to create sustained growth and cash flows. Ultimately, it’s the growth in the business and the growth in cash flow [that are] going to enable this entity to achieve the promise that you referenced earlier.

How does one go about doing that? You need to look at many different firms and to look for critical differences among those firms. Maybe that comes back to trying to understand a bit about their history, their track record. For example, when a deal didn’t go right, what did they do? Did you just sell out? Instead of staying in the deal for 5 years, did you end up staying in a deal for 13 years because you believed in the team, the vision, and the strategy? Those are the kinds of things I’m looking for. I want to find a great business partner who’s going to help me to achieve our long-term objectives.

I’ll go back to the question you posed to Dan, Alan. I don’t know if it’s going to be any different this time around, because people are prone to repeat their mistakes. Some of that is fueled by greed and, in some cases, simply a lack of understanding of what it takes to build a great business. I advise my clients [to] think like a financial investor. Dan referenced a need for achieving a certain rate of return. Most of these firms want in, and they want out in a relatively short period of time. The truth is you need someone who’s willing to dig in with you and to build something and to not build it necessarily through acquisition but also in an organic fashion. That requires patient, thoughtful investors who understand what it takes to build a terrific business.

Reider: How do you find those people?

Maller: What would I do knowing what I know? There are about 40 to 50 different private equity firms that are apparently interested in the ophthalmology space. I’ve probably spoken to between 15 and 20. I always start my discussion with trying to understand the vision of the firm in the space. Do they have one, and what does it sound like? When you’ve spoken to 15 of these individuals, you can quickly take the 15 and narrow the field to three or four. There are certain elements about them that I would say differentiate [them] from the others. Number one is they’ve done their homework. They have studied the space in great detail. They know who the players are. They understand the different business models in ophthalmology. They understand the third-party payer world, and they have a pretty good sense of what it takes to build a great business.

The second dimension is their track record. These firms have public websites. You can go to them and identify the types of deals they’ve done, or not, as the case may be. Some private equity firms specialize in health care, but that doesn’t do you any good if they’ve never worked or invested in the physician service sector. If they have invested in physician services, study the specialty areas they have invested in. Are they predominantly hospital based or not, as the case may be? The types of specialties that would be germane are not hospital based but instead would include dermatology, dentistry, physical therapy—specialties that function in some ways in a similar fashion.

The third dimension would be to meet the principals of the firm(s) and to spend quality time, both in a business and [a] social setting. Granted, they may be out of the deal in 5 years, but they’re going to be alongside you to assist in building the business. Alignment of the vision and values [is] paramount.

How do you find them? Do you go directly to private equity firms or use some type of broker or intermediary? There are pros and cons to each approach. My sense is [that] the majority of practices interested in pursuing investment with private equity have hired an investment banker to represent them with the process. Regardless of which path a practice may choose, the important factor is to have a well-thought-out process and to stick to that process and not compromise the things that are most important.

Reider: What should the practice expect as a part of the due diligence? When there’s a potential transaction, [the practice] is going to get examined very closely by the private equity firm, as well it should. To your point, Bruce, the practice should be doing the same thing with the private equity firm, to understand what the private equity firm’s vision is, to understand what the private equity firm’s plan is, to make sure they have the expertise, the strategy, and the vision—no pun intended—to take it where they want to go. Too often, it tends to be a one-issue due diligence, which is: What’s the multiple?

Private Equity Insiders Offer Perspective and Advice

By Stephen Daily, Executive Editor, News

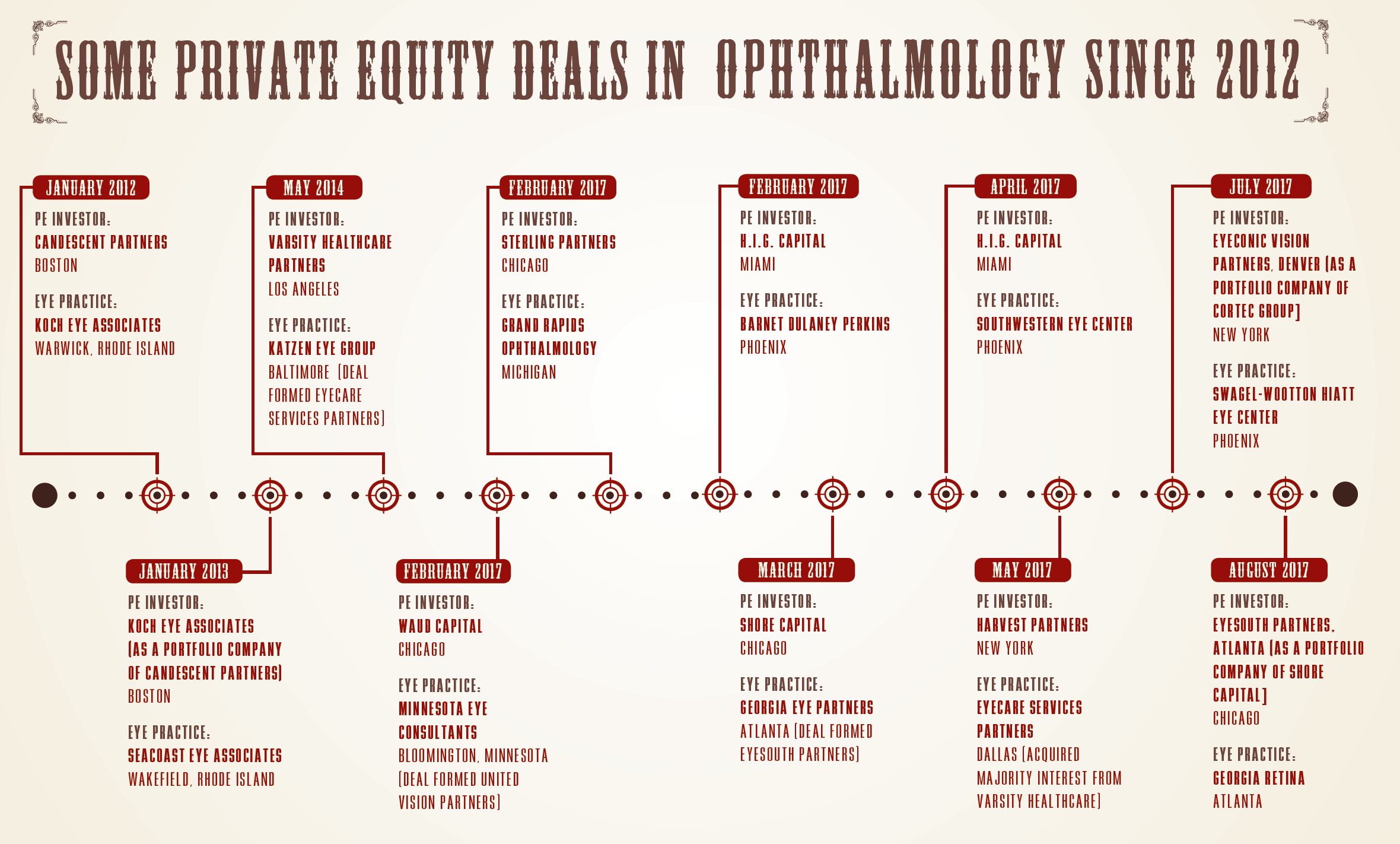

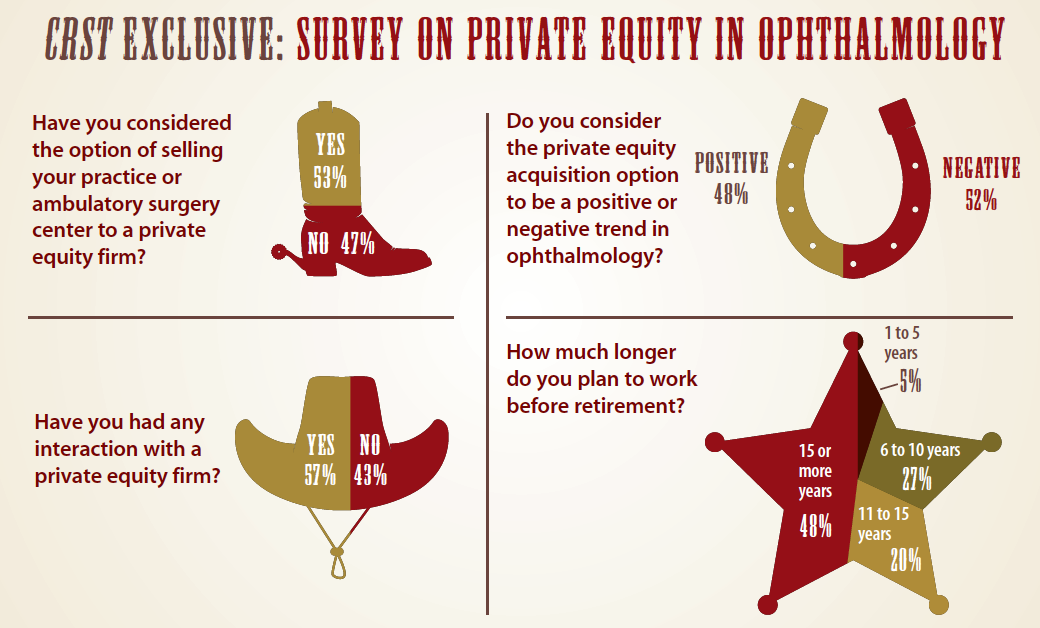

The medical field has seen a sharp increase in consolidation and private equity activity in recent years, particularly in the dentistry, oncology, and dermatology segments. In the past 3 years, however, a new specialty has emerged with many of the attributes private equity companies long for—eye care.

After a 25-year hiatus, private equity companies have returned to the eye care market, this time better equipped to manage the obstacles that might have been mismanaged in the past. Private equity capital is flowing into the large, more established practices first and seems destined to continue its outreach in the highly fragmented eye care space.

One of the first recapitalizations of an ophthalmology practice occurred in May 2014, when Los Angeles-based Varsity Healthcare Partners, a private equity investment firm focused on health care services, acquired Baltimore-based Katzen Eye Group, one of the nation’s largest ophthalmologic and optometric services practices. Through the partnership, the two entities formed EyeCare Services Partners Holding. Although such a private equity deal might have been uncommon at the time, the partnership has proven to be lucrative for both parties. Katzen Eye Group expanded its reach to 46 practice locations and seven ambulatory surgery centers (ASCs) across five states.

David Alpern, cofounder and partner at Varsity Healthcare Partners, was instrumental in that deal and in the revival of private equity’s interest in vision care.

“We had a thesis about ophthalmology and began looking for practices in early 2013,” Mr. Alpern said. “[We were] literally going around the country looking at different practices. [Katzen Eye Group] had all the attributes of what we were looking for in a platform. Not only did it have primary, secondary care, and an ASC, it had great diversification in terms of its providers, meaning no one provider controlled all the collections of the practice; it was pretty well diverse. The compliance, the culture was fantastic in this practice.”

Mr. Alpern’s foresight and due diligence paid off. In June 2017, the so-called second bite of the apple occurred when Harvest Partners, a New York-based private equity firm, acquired Varsity’s majority ownership in EyeCare Services Partners. The deal furthered the payoff of the deal made 3 years earlier and marked the first successful exit for a private equity firm in the industry.

Another high-profile deal occurred in February of this year when Chicago-based Waud Capital Partners announced a partnership with Minnesota Eye Consultants, which formed United Vision Partners.

Minnesota Eye had established itself in the Minneapolis-St. Paul area and provided Waud Capital with a diversified eye care portfolio, which included surgical and nonsurgical eye care services through a network of six offices, including four that operate ophthalmology-focused ASCs.

Chris Graber, principal at Waud Capital, said the appeal of Minnesota Eye was the strong culture that was already established as well as the comprehensive offerings, which included academics, research, clinical practice, and business operations.

Matthew Owens, partner at Arnold & Porter in Washington, DC, has advised clients on all aspects of mergers, acquisitions, and divestiture. Mr. Owens represented several of the ophthalmic practices involved in private equity deals in recent years—including the Waud Capital/Minnesota Eye deal—and has a unique perspective on the renewed interest. He says the number one reason for private equity’s interest is simple supply and demand.

“The demand for ophthalmology is increasing because of the aging population,” Mr. Owens said. “You’ve got the baby boomer generation, this 55-and-older generation, that’s starting to really increase. And so, demand is going up, but my understanding is that the supply’s going down. There’s just not a lot of people getting into ophthalmology, and so it’s really creating these market dynamics.”

Mr. Alpern agrees and said, when it comes to investing in vision care, there is attractive secular growth, catalyzed by the aging US population.

“There [are] roughly 18,000 licensed ophthalmologists in this country,” Mr. Alpern commented. “That’s a really small specialty. Just to give you a point of comparison, there [are] about 180,000 dentists in the United States. So just fundamentally, there’s a supply and demand imbalance with respect to need for treatment and the number of people that can actually provide that treatment, which means practices should be very busy over the next few years.”

Another key component, Mr. Alpern stated, is the multiple revenue touchpoints with each patient. First, there is primary care and the optometrists. Then, there is secondary care, including the ophthalmologic surgical services (cataract, refractive, glaucoma, and retina). Third, there are outpatient surgery centers that are often required to perform these surgeries.

“All of those people are in a position to treat a patient to the extent that [the] patient develops different and multiple chronic eye abnormalities,” Mr. Alpern said. “So, if you own an integrated ophthalmology practice, you have the ability to participate in optometry, you have the ability to participate in all the different subspecialties within ophthalmology, and you can get paid by virtue of the fact that you can have your own surgery center.”

Mr. Graber explained, unlike some other medical specialties, there are strong underlying demand drivers in the ophthalmology market as well as multiple avenues for growth.

“Our firm focuses exclusively on growth opportunities, so the multitude of growth opportunities, including opening new sites, expanding services and growth through acquisition, all make the sector attractive from an investment perspective,” he said.

Another allure of ophthalmic practices for private equity is the pay structure—specifically the combination of insurance-pay and cash-pay models for premium services—along with diversification of offerings.

“It’s a good mix that appeals to private equity,” Mr. Owens commented. “I think the fact that a lot of these practices have surgery centers, they’ve got these ASCs, it’s just a very appealing sort of diversification of the business model. [Private equity firms] can come in, and they can own these surgery centers, whereas with the practice, that’s a little complicated. They can’t own them outright, but they have to manage them. … There’s a lot of opportunity here in terms of scalability and synergy or efficiencies.”

Risks of Private Equity

When it comes to risk and private equity, a lot of the focus tends to be on the seller’s side. After all, in the 1990s, many ophthalmology practices aligned with private equity groups by selling to physician practice management companies (PPMCs). Although promises of greater operational efficiency and higher returns were made, the PPMC model, which focused more on a centralized approach toward management, ultimately failed for a variety of reasons. A panel of experts participating in CRST’s roundtable in this issue attributed the failures of the PPMCs to poor economies of scale, failure of leadership/vision, and a lack of employee incentives.

The new round of private equity investment focuses more on the short term, ideally maximizing value and selling to another group within 5 years, as demonstrated recently by Varsity Healthcare Partners. Another difference in today’s private equity climate is that the buyers are paying much more of the sales price in cash and only a relatively small amount in stock.

Although it is incumbent for eye care practices to do their due diligence before partnering with private equity, there is also significant risk to consider on the private equity side. Determining the right practice, location, and price at the early stages of the sale is only part of the equation. Private equity firms must also carefully consider the postsale business model. This includes which practices or assets are going to be integrated and whether the practice is going to be durable.

“The risk in the investment in any buy-and-build, really not specific to ophthalmology, is how well you acquire those next practices, how well you integrate those next practices,” Mr. Alpern said. “That’s where I believe all the money is really made and lost in these deals.”

In addition, keeping physicians and their staff motivated is critical and what many believe is the key determining factor of the ultimate success of the deal. Private equity firms must determine the likelihood that the entrepreneurs who started the business will remain committed and continue to drive value for the practice once private equity has bought it.

“I think there’s real concern there,” Mr. Owens commented. “If you give [the sellers] too big of a payday on a closing, there’s a lot of risk and what’s their motivation? Are they all of a sudden going to put in 80% of the work? And then, all of a sudden, your models don’t work, and all your projections are thrown out of whack.”

To mitigate some of the risk, private equity firms are more often keeping incentives in place after the sale.

“These days, private equity is putting so much on rollover equity,” Mr. Owens said. “They want these doctors to take back a significant chunk of the purchase price proceeds in equity, because they want to align those incentives and make sure that these key physicians that were driving the value before closing have every motivation to drive value postclosing.”

Culture and Staffing

Many physicians, particularly those who started the business, are used to calling the shots. Even with appeal of a large money infusion, giving up control is a challenge some physicians may find difficult or even impossible.

“This is not venture capital, where you’re giving money and sitting on the sidelines,” Mr. Owens explained. “Private equity comes in, they pay a lot of money, and they expect to run the show. And, I think there is a lot of risk there, depending on the culture and the personalities with the practice you acquire.”

Sometimes, physicians may benefit, beyond financially, Mr. Owens said, if they are able to allow others to come in and take on some of the administrative roles.

“Doctors aren’t businessmen, right?” he said. “They’re really good at practicing medicine but not always good in running a business. And so, you come in, and you buy up three, four, five in a market, and you consolidate back office support in one area. You’re probably going to drive some efficiencies and some synergies out of combining all of these practices. An outside management team comes in and really knows how to drive things. And then, you just sort of build upon it, you build that scalability, and I think that’s appealing.”

Mr. Owens noted that it takes a certain kind of private equity professional to come in and know how to find the correct balance.

“Be as hands-off as you can but while making your strategic changes that you think you need to help grow the business,” he advised. “And, really create a partnership, and don’t make it seem like it’s too much of a dictatorship.”

Mr. Graber emphasized the importance of choosing partners carefully—on both sides of the deal.

“Determine why it is that you are interested in a transaction, and then talk to the people with whom your potential partner has worked,” he recommended. “A group like Minnesota Eye had many people interested in partnering with them. They also had a variety of objectives that they were seeking to achieve, and so you need to find the right balance in all of those objectives.”

Beyond motivation, there is also the issue of employee retention. Many staff members may decide to leave the practice if they do not see the direct benefit of the private equity transaction.

“That’s a real risk and one of the reasons that, in a lot of these deals, private equity requires not only the sellers but some of the key employed physicians to sign up to new employment agreements with tighter noncompetes,” Mr. Owens said. “And, quite frankly, that’s one of the trickiest things to negotiate in these deals.”

When evaluating a potential partner, sometimes, it comes down to getting “inside the head of the psychology of the provider,” Mr. Alpern said.

“I think [ophthalmologists] are fiercely independent people and fiercely independent thinkers,” he explained. “You need to constantly engage that workforce as a larger consolidator of lots of different practices, and so I think it’s incumbent upon the private equity fund to set up mechanisms to do that. Moreover, you’ve got to be very careful about preserving clinical autonomy for those providers and not getting in the way of what they are really good at, which is great care.”

How do doctors stay motivated?

Reider: A point that I heard much earlier—and I’ve seen this in criticisms of the PPMC industry as well—is, how do you keep the physicians incentivized? When the physician is getting paid upfront and is no longer generating the revenue for himself or herself, that tends to reduce [his or her] incentive to work very hard. How do you address that? That seems to me to be such a fundamental question. Jeff, how do you stay interested if you’re not generating the revenue you used to from the work that you’re doing?

Whitman: Part of that has to do with selecting the right partners. I think it goes both ways. I love doing what I’m doing, and I think that I can stand back and say, I’ve been paid something significant upfront to incentivize me to continue to work hard. That is kind of a tit-for-tat action in that I’m getting paid to do that. It wasn’t all for the past; it was for what’s coming up in the future, too. Plus, if I can see my practice growing, I think that some of that accrues to me as time goes on. But, I agree. I think the hardest thing still becomes for the younger partners that may not see the advantage over time.

Reider: You’ve got younger physicians as part of your practice. How do they react to all of this? What’s in it for them? How can we present this, or how do you present it to your younger physicians to say, this makes sense for you just as it makes sense for me?

Whitman: If it makes sense for me, I think it can be described in a way to younger physicians that it makes sense for them. That said, I really feel like they don’t know what’s going on out there. There are a couple who’ve asked me, because I have friends in dermatology perhaps that have done some kind of a roll-up, but only because they know other people. They really have not considered it for themselves at this point. So, I think to be able to do this, I would have to find a company that would be a good partner, as we’ve just been talking about, that I believe can grow the company, which means growth for everybody in the company. If that can be demonstrated and be believable, I think, then, it’s easier to bring younger physicians on board. Right now, I don’t believe they have any clue about what’s going on with private equity.

Reider: Trent said earlier that perhaps the younger ophthalmologists today have different incentives. Maybe their incentive is more a work-life balance. Maybe they’re not as focused on the dollar as perhaps the entrepreneurial generation was. I’m outside, but you all are inside the industry. Is this something that you see? Does this make it easier or more difficult to make the move to private equity?

Chambers: I think there is a general difference in younger ophthalmologists today. Not only do they want to work fewer hours, but they also want the same amount of money that physicians used to get and what they asked for, which makes it challenging. We are starting to see some income production models lowered with a lot of increased overhead, regulations, and challenges with lowering reimbursement. The other thing that we really haven’t talked much about yet is debt. In practices where a lot of the senior doctors may have taken on debt or excessive debt, younger doctors don’t want to take on those debt guarantees. When you want to really expand or grow or acquire or consolidate, it often takes a fair amount of additional capital investment, which, in today’s world, is a risk for senior doctors with respect to their time frame. There’s also a harder problem to borrow money from banks under the current regulatory requirements. So, you’re starting to see private equity become the funding mechanism for organizations to grow, very similar to the way Bruce mentioned, that your vision is to grow by adding more valued services and acquiring local practices to gain synergy. That’s going to take some investments, maybe sizable investments, which individual physicians aren’t able to do as easily as in the 90s. That is one way you might be able to incentivize younger physicians, which is providing access to capital without personal guarantees that banks require. It’d be harder, I think, with younger physicians to gain equity, but how you structure that is critical. Sometimes, a small fish in a big pond isn’t really an incentive for them, so you have to be careful in how you structure that organization.

Maller: I think this comes down to the sustainability of an ophthalmology practice and affiliated surgery center. The business model is predicated on the ability to attract and retain young surgeons. If I’m a younger physician, what’s in it for me, and how is this really going to work to ensure that my needs are met? There are really two potential stakeholders here: the young physician surgeon who is already a partner, who might participate in the financial transaction, versus the young physician who hasn’t yet joined or has already joined you but is simply an associate. It is very important to anticipate the needs of the younger surgeon and to have a compensation and equity ownership plan that “marks to market” and keeps them motivated.

I believe forward-thinking investors and executives are going to develop the right structure to address this issue.

It is also important to consider how best to create alignment of incentives with the executive leadership and senior management teams. This is an area that is often overlooked.

Reider: I think that one of the benefits of the private equity model is that it provides opportunities for professional managers to participate in operating multiple medical practices in a way that is not available to an independent medical practice. Private equity can put together a very attractive package to try to address all of these issues we have discussed that confront medical practices today. While it is understandable that physicians want to know what the multiple is, they also should want to know what the plan is. How do we make this work 5 and 10 years from now? Private equity should have a good answer to that question, because the proper way to motivate the physician is to say, we want you to continue to have an interest in the future success of this enterprise through your equity in the management and the manager for a long, long time. That’s how the physician stays interested, because all the sweat that the physician puts in goes to enhance the value of the manager.

Who is a candidate?

Reider: We’re starting to see a crescendo in activity here. Is this model for everybody? I mean, should some people stay away from private equity? How would you define a practice that just shouldn’t go there?

Roark: A common thread through all of the comments seems to be “physician know thyself.” I’ve had physicians who have said point blank to me, “I could never work for somebody else.” Obviously, those are people to exclude from seeking a private equity buyer. I think you have to look at your practice as well. What is your succession plan? What is the availability of some other doctors coming in and being able to buy into a large practice? Does the practice have a great deal of debt? What is your aversion to risk? Are you willing to borrow money to capitalize your practice—money for hiring new staff, starting a new line of service, or acquiring another practice for growth? Those are some of the things that I think have to be asked. If you are not comfortable with your response to these questions, then the private equity model is probably not for you.

Reider: Bruce, what kind of a practice do you think fits best with private equity? What are some of the key characteristics that a private equity [company] is looking for? [Put another] way, what should I do in anticipation of being looked at by private equity to make myself more attractive?

Maller: Not every practice is a target for private equity. High-risk capital demands a high rate of return, much higher than one could get investing in a stock or a bond. To achieve this goal, the business needs to achieve significant growth in operating cash flow. Achieving this objective requires a scalable platform. When I say platform, I’m referring to the operating infrastructure.

You said it at the very beginning: the larger trend that we’re addressing here is one of consolidation. A private equity firm is a vehicle to assist in facilitating market consolidation. Not everyone is interested in that. To Trent’s point, you really need to look inward and do your own strategic assessment before you go down the path of entertaining discussions with private equity. Physicians are hearing about friends that have done deals. What a practice or a group of physicians needs to do is look inward, do their own strategic assessment, understand their market, understand their practice, understand their goals, [and] see if they can’t gain consensus on vision. That’s step one.

To the extent that they have consensus on who they want to be when they grow up, a financial partner may or may not make sense, or it may or may not even be necessary. Many large practices are perfectly capable of financing their own growth through debt and/or equity. Some practices that are larger, that have a strong balance sheet, that have retained earnings, are in the position where they can do acquisitions, where they can borrow money, and they don’t necessarily need an outside investor. In my opinion, it’s a relatively small number of practices across the country that meet the criteria and would be a viable target for private equity.

Reider: Are there practices that can say, “You know what? It’s not for me, and I’m not worried. I can survive and thrive in this environment.”

Maller: Absolutely.

Reider: That’s an important message, because from what I’m hearing, everybody is in a bit of a panic. There’s an old adage that says, never run away from a job; run to a job. It’s almost the same thing here. Never run away from what you’re doing; run to a new opportunity. I don’t know if that’s a fair statement.

Maller: It is a fair statement. If you have strong group governance, if you have a strong balance sheet, if you’ve got a strong vision and committed partners and a strong management team, you can, of sound mind, determine that private equity might be a great vehicle to help you strengthen your core business. On the other hand, if you’ve got the element that I just alluded to, I don’t necessarily need a financial partner to help me achieve my objectives. I know exactly what I need to do in my market, and again, I can finance growth and acquisition.

If I’m in a market where private equity has already made an investment in a competing platform, that could be challenging. A private equity-backed practice will create disruption by possibly bidding up the value of other practices that [might] have otherwise been targets for your practice.

I take a very neutral position on this. It is not for everyone.

Reider: [Suppose] somebody says, “I’m struggling here. I’m overwhelmed by the administrative burdens. I’m concerned about getting cut out of insurance panels. I need to do something, but private equity either doesn’t seem to be for me or they’re not interested in me.” What are the other options out there for practices?

Robert J. Weinstock, MD, talks to J. Matthew Owens, JD, partner at Arnold & Porter Kaye Scholer, and Mark Rosenberg, now vice chairman of the Board of Directors, American Vision Partners, about the opportunities and reality of selling a practice to a private equity firm.

Chambers: There is consolidation. We have acquired three or four practices over the past 5 to 7 years for those very reasons. The physicians are getting tired of dealing with the regulations. They feel isolated. They, I think in our cultural situation, maybe enjoy the “groupness,” collegiality, and yet [have] been able to retain a model of individual financial performance by location.

So, I think that there are alternatives to private equity. If you can run and keep your debt at a relatively low level, then I think you can create enough harmony. However, debt may accelerate growth, and you just have to balance those two. Also, I doubt seriously if private equity is all that interested in the rural area, and there’s a lot less competition in rural areas. You don’t have much to fear, and managed care is not all that strong in rural areas. You get into high-density urban areas where there’s a very strong growth of managed care groups or [a] narrow network or cost-control issues or regional hospital systems, [and] I think you’re going to see a lot more activity. Individual physicians are going to be more concerned about their longevity, and consolidations will most likely represent improved negotiating power if they can join an existing group with additional geographical coverage as an effective team player.

Reider: Jeff, you have already done some consolidation on your own. From your perspective as the ophthalmologist now working more closely with other professionals, how has that worked out?

Whitman: It’s definitely been a plus, and again, it’s more geographic diversity regionally where we are. I think that can help in offering yourself to different insurance networks, hospital networks, that you solved more than one problem for them, where we can offer them an efficient practice in more than one area.

Reider: Any governance or personality issues in connection with this kind of consolidation?

Whitman: Always. I think that’s something you have to look at [with] private equity [as well]. Governance and different opinions, particularly amongst ophthalmologists, [are] very hard to judge before you become partners.

Maller: I always think it’s important to try and project life after doing a transaction, say with private equity. The truth is that the financial partner is going to have control going forward. Now granted, the smart investor will want physician and executive leadership at the board table, but the way decisions will get made in this company will be different. It won’t have the same level of physician control as it did previously. Depending upon the partner that you choose, that may feel very different, because the motivation of a financial investor is all about growing cash flow. That’s the only way, ultimately, they see a return on investment.

I’m not saying a financial partner can’t bring the much-needed discipline. There are many benefits that private equity brings to the table. But, if you’re a physician group that is accustomed to making your own decisions, and now you must collaborate with a business partner, I’m telling you that is not easy to do. The first time the financial partner says, oh by the way, we need to eliminate a million dollars in overhead expense so we can hit our EBITDA [earnings before interest, tax, depreciation, and amortization] target this year, trust me, there will be tension in the room.

What are the key take-away points?

Reider: If you had to give one piece of advice to a practice considering private equity, what would it be?

Roark: I’d stick with, physician, know thyself, because your attitude, your ability to comply with others, to be subservient in some cases, because the private equity [firm] owns the company now, can make or break the whole experience.

Chambers: Be prepared to lose financial control over your organization and to live with that. Decisions will be made in cooperation with the financial interests of the organization and may not be what you have traditionally done.

Whitman: Know who you’re getting in bed with, so to speak. If you can talk to someone, particularly in your own specialty, who has done it already, to see how that partner is to work with, I think that would be a tremendous advantage. At the very least, if they’re in a different area of medicine, dermatology let’s say, talk to somebody that’s already done a deal with them to see how life was after the deal. I think that really gives you an idea of what to expect and can make you go or no-go on that acquisition.

Maller: Although I’d be the first one to say the multiples that are being offered are very attractive and we may not see anything like this in the next 20+ years, it’s important not to be too reactive or to feel as though you need to do something tomorrow. The best piece of advice, as I stated earlier, is to engage in your own objective evaluation of your practice. Go through the typical strategic exercise of identifying your strengths and weaknesses, your opportunities, [and] your threats. Understand your market, understand your practice, and make a decision, ultimately, because it’s the right thing to do for the business.