One year ago, as the number of COVID-19 cases surged, the avid interest of private equity (PE) investors in the US health care sector suddenly came to a halt as they watched the industry mobilize against SARS-CoV-2. Emerging transactions came to a standstill; mergers, acquisitions, and PE deals were placed on hold indefinitely or fell apart; and the courtships between practice owners across all health care specialties, PE funds, strategic buyers, and investment bankers largely stopped. All stakeholders wondered if, when, and how the health care industry would rebound. The halt of PE’s interest in health care was brief and confined mostly to the second quarter of 2020, but it had consequences for the eye care sector at multiple levels.

A QUICK REBOUND

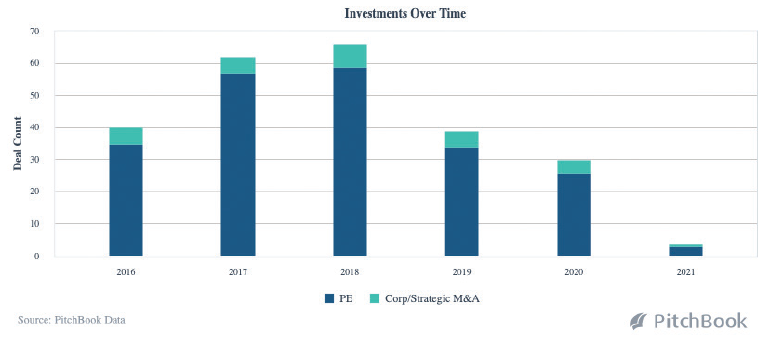

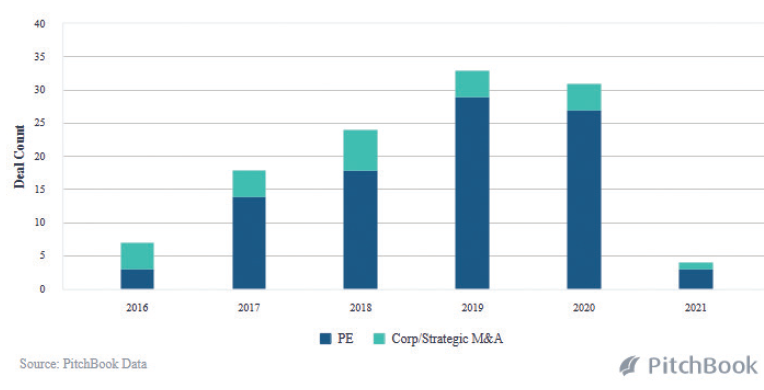

Unlike in dermatology, consolidation in the eye care sector had just started heating up in early 2020 (Figures 1 and 2). Following the temporary halt in elective surgeries in the second quarter of 2020, most ophthalmologists had returned to operating by the third quarter of that year. Deal-making quickly rebounded after the halt in the second quarter and lasted into the end of the year. Several transactions that had been put on hold at the start of the COVID-19 pandemic resumed, some of which closed by the year’s end, ahead of concerns over future tax changes (personal communication with N. Johnson, Lawrence, Evans and Co, February 2021).

Figure 1. Dermatology deals made between 2016 and 2021.

Figure 2. Eye care deals made between 2016 and 2021.

The number of eye care deals that closed in 2020—a total of 31—indicates that the COVID-19 pandemic has affected the consolidation in eye care only minimally (Figures 2 and 3). Merger and acquisitions professionals report an uptick in deals nearing pre–COVID-19 levels. This is in part because eye care enterprises, more than other specialties, have demonstrated extraordinary resistance to COVID-19 and velocity in recapturing pre–COVID-19 productivity levels during the pandemic.

Figure 3. Eye care provider deals made in 2020.

Figures courtesy of Lawrence, Evans and Co

Current PE investments are an estimated $2.5 trillion, and about 25% of that is allotted for health care. With this amount of potential investment, small and large eye care providers in the United States and internationally will continue to be pursued aggressively for acquisition in 2021 (personal communication with N. Johnson, Lawrence, Evans and Co, February 2021). Routes for consolidation include partnering with majority or minority PE partners, joining an established platform, establishing a new platform, adding locations, or staying independent (personal communication with R. Kothari, Cascade Partners, January 2021). PE investors are also interested in the ophthalmic devices market.1

DEAL DRIVERS

Multiple factors fuel the velocity of mergers, acquisitions, and partnerships in the health care sector. At the macro level, revenue for the physician specialty is expected to grow at an annualized rate of 2% through 2024. This is a result of the following:

- Growing and aging demographics;

- Strength (> 50%) and growth of revenue generated by private health insurance payments;

- Improved access to health care;

- Advances in technology; and

- Consolidation (personal communication with A. Newman and H. Torres, FocalPoint, January 2021).

Additional drivers include the fragmentation of the physician practice sector, particularly within the eye care segment; the reduction of in-house clinical specialty service lines across hospitals and health systems; and the symbiotic relationships between these hospital and health systems and independent practices to deliver value-based care (personal communication with A. Newman and H. Torres, FocalPoint, January 2021).

The eye care sector, and in particular ophthalmology, is growing at 4% to 5% per year. At the micro level, this represents a vastly untapped and compelling investment opportunity for PE, even in the midst of the pandemic (personal communication with A. Newman and H. Torres, FocalPoint, January 2021). The approximately $40 billion eye care industry is positioned to benefit from the convergence of two key trends: an increase in the demand for services based on a growing and aging patient population and a demonstrated shortage of ophthalmologists driving compensation and competition for talent recruitment and retention.

The operational complexity of managing multiple practice locations and specialties (eg, retina, corneal disease, glaucoma, cataract surgery, refractive surgery, optometry, optical), the pressure to increase per-patient revenue by adding specialists and ambulatory surgery center services to amortize escalating costs, the recurring investments in medical and operational technology (eg, electronic medical records, telemedicine, call centers), the need to constantly improve marketing efficiency to maintain or grow market share, and the importance of market density to negotiate payer contracts are additional elements that will precipitate consolidation. This will come either in the form of PE investments or practice aggregation through supergroups or local mergers. With a few exceptions, such as the Cleveland Clinic Cole Eye Institute, hospitals and health systems are not participating in this trend.

CURRENT OUTLOOK

PE firms view eye care as a fragmented market ripe for consolidation through bolt-on acquisitions and platform investments (Table), but the COVID-19 pandemic is directly affecting the current financial structure of PE transactions. As is often the case in mergers and acquisitions, larger scale—all else being equal—means larger value. Generally speaking, physician specialty practices with the following normalized earnings before interest, taxes, depreciation, and amortization will garner multiples as follows:

- Under $3 million: 5 to 7x;

- $3 to $5 million: 7 to 9x;

- $5 to $10 million: 9 to 10x; and

- More than $10 million: greater than 10x (personal communication with C. Lawson, Cowen, February 2021).

Source: FocalPoint

At the beginning of 2021, investment bankers reported downward pressure on the multiples in the range of 10% to 15% for large practices and 20% to 25% for small practices (personal communication with H. Torres and A. Newman, FocalPoint, January 2021). As a result, PE is concentrating investments on bigger and more capitalized platforms. It is seeking to replicate one consumer-centric model across targeted geographies and capture the full spectrum of pathologies and surgical, office-based, and aesthetic eye care treatments under one umbrella.

A number of bigger platforms that were on the market before the pandemic are not yet back on the market. As a result of the current decline in multiples, PE investors may need to keep their ventures longer to recoup their investments. Only time will tell how long this trend will persist, but it may provide an edge to strategic buyers over PE over the midterm. Nonetheless, valuations for top-quality eye care platforms remain largely unaffected by COVID-19 due to high demand and low supply.

In addition to its effect on multiples and the pace and shape of consolidation, the COVID-19 pandemic is having a ripple effect on the risk tolerance of buyers. In short, buyers will typically overlook 2020 and either use 2019 as a performance benchmark or account for some form of credit for the negative effects of COVID-19. They now also, however, place more structure and conditions on the proceeds of the transaction, such as the use of additional rollover equity (20%–30%), a higher degree of financing, deferral of a portion of the purchase price, and earnouts as a mechanism to pay all or part (most common) of the purchase price after the closing based on the performance of the seller’s business in the hands of the buyer (personal communication with C. Contini, McDonald Hopkins, November 2020).

These new contingencies may bridge the purchase price gap between buyers and sellers and allow buyers to ensure that the business will perform as expected after the dip in revenue as a result of COVID-19. Sellers should also scrutinize the methodology and conditions of the earnouts to maximize their ability to receive the full amount of the earnout during the prescribed postclosing period. From a risk standpoint, more indemnification claims from the COVID-19–era deals are likely, potentially leading to contractual postclosing purchase price adjustments (personal communication with J. Proia, Cross Keys Capital, February 2021). The core transactional and structural changes that stem directly from the risks associated with COVID-19 are expected to persist after the pandemic, adding technical complexity and risk to already complicated transaction processes.

On a positive note, distressed asset sales are not expected in the eye care market, unlike in retail and other health care segments, including long-term care and critical care hospitals.

Preparing Your Practice for a Potential Future Transaction

- Make sure your business is properly structured under applicable state law for maximum tax benefit at closing and have all of your organizational and other corporate documents in order, including employment contracts and ownership agreements.

- Analyze the compliance of your coding and billing practices and business relationships with referring physicians and suppliers.

- Analyze the compliance of your provider compensation and profit distribution methodologies, especially as applicable to services provided at ambulatory surgery centers (professional fees vs facility fees).

- Implement, where legally permissible, restrictive covenants such as noncompete, nondisclosure, and nonsolicitation agreements with key clinical and nonclinical owners, professionals, and staff.

- Put sound and accurate financial systems in place.

- Obtain a quality-of-earnings analysis from a reputable accounting firm and an external coding audit, which are considered best practices in private equity deals.

KEY RECOMMENDATIONS FOR PRACTICE OWNERS

Eye care practice owners can take advantage of the following pragmatic recommendations:

1. Multiples and valuations may have slipped, but they are expected to rebound slowly after the pandemic. This is an opportune time to study your options carefully and stay apprised of market trends. Even if you are not currently looking to sell, you can prepare your practice for a potential transaction in the future. Some suggestions are outlined in the accompanying sidebar. Adopting these fundamental proactive measures is likely to increase the value of future offers and reduce transaction expenses (personal communication with C. Contini, McDonald Hopkins, November 2020).

2. You do not need to sell, and you do not need to sell now. You can keep practicing as you are and plan to grow organically on your own. It is important, however, to educate yourself about opportunities and remain aware of risks for your practice, such as the rise of a large ophthalmology platform in your area.

3. Do not initiate any process unless and until all the practice owners agree to commit to a potential deal. Failure to obtain consensus at the outset can negatively affect the deal terms, prolong negotiations, increase transaction costs, and damage shareholder relationships.

4. If you are approached by a potential buyer, do not leap at the first opportunity even if the offer is attractive. Assess multiple offers by yourself or through an investment banker.

5. Beware of buyers that lowball your business’ value, pressure you to lock in an exclusive deal quickly, denigrate the value of engaging an investment banker or lawyer, and/or pressure you to move forward at an uncomfortable pace for you or your partners. These are generally red flags. You should conduct due diligence about the buyer.

6. Confidentiality is essential. Refrain from giving an inquiring party confidential information without a nondisclosure or confidentiality agreement and carefully assess how to protect against the unwanted disclosure of deal negotiations that can lead to concerns within your practice and potential loss of key personnel.

7. Do not sign a document without legal counsel or advice from an investment banker. Letters of intent ink key deal terms that can be tough to walk back and typically contain some exclusive dealing language that prohibits discussions with another party for a period of 90 to 120 days.

8. Purchase price is only one of numerous elements of any deal (personal communication with R. Cooper, Esq, McDonald Hopkins, November 2020). Other crucial elements to consider include the following:

- What are the structure and terms of the purchase price, including the total amount, the portion paid in cash, the portion attributable to ownership in the buyer’s entity, earnouts, or any other at-risk amounts?

- Does the buyer have a high regard for proper clinical practice?

- Do you respect the other providers who have already joined the buyer?

- Do you like and trust the buyer?

- Does the buyer’s strategic vision match yours?

- Do you anticipate a clash of cultures?

- What will happen to your staff and practice location(s)?

- What are the key financial and other terms of employment, including how long you have to commit to be employed by the buyer, and if you leave, what noncompete restrictions will you be subject to?

- Does the buyer have appropriate advisors (eg, health care compliance attorneys, investment bankers)?

CONCLUSION

Ophthalmology and optometry will remain the target of PE investors for the foreseeable future. Does PE bring opportunity or illusion? To answer this question, boost your understanding of PE-led merger and acquisition transactions and do not let your uninformed peers and partners influence your judgment.

PE firms are adapting quickly to the success of building practices. Increased alignment with physicians, risk sharing, and established infrastructure for growth are valued much more highly by PE firms than even a couple of years ago (personal communication with R. Kothari, Cascade Partners, January 2021). Only you can decide if a PE deal is right for you and your practice.

1. Clearwater International. Increasing M&A activity in the ophthalmology market. Accessed February 9, 2021. https://www.clearwaterinternational.com/publications/healthcare-blog/increasing-m-a-activity-in-the-ophthalmology-market