Because the course of an ophthalmologist’s career is unlike that of most other professions, especially with regard to debt-to-income ratio, it is imperative that these individuals implement innovative financial planning in order to maintain their desired lifestyle in retirement.

In the early years after college, when many of their peers begin to save for retirement and perhaps invest in a home, future eye surgeons are busy continuing their education and completing residency and fellowship training. During that time, they not only postpone earnings but also often accrue significant debt. Eye surgeons can make up for lost time by using less well-known retirement savings vehicles, such as by offering a cash balance plan within their surgical practice, and by pursuing alternative investment opportunities, such as investing in a medical office building or ambulatory surgery center (ASC), if eligible.

DEBT AND DELAYED INCOME

According to the Association of American Medical Colleges, 76% of medical students graduate with student loan debt, the median level of which was $190,000 in 2016.1 As a result, student loan repayments can be more than $2,000 per month. Because the repayment schedule for these loans can be as long as 25 years, some eye surgeons may still be paying off medical school debt at the age of 55.

During their education and training years, eye surgeons miss out on nearly a decade of compounding interest on savings—one of the most powerful tools in building retirement savings. Other factors that affect retirement savings for eye surgeons are the very high tax brackets that they fall into and the fact that they usually have to pay full tuition for the education of their children.

Because the annual contribution limit for employees who participate in 401(k)s and other traditional retirement plans is $18,500 for those younger than 50 years and $24,500 for those 50 and older, these traditional retirement vehicles may be insufficient to enable eye surgeons to save enough to retire comfortably. This situation calls for innovative financial planning strategies.

CASH BALANCE PLANS

Eye surgeons who are partners in their surgical practices should consider offering a cash balance plan for retirement savings. What sets these plans apart from other savings vehicles is that they have higher contribution limits that increase with age.

For eye surgeons who might be playing catch-up on retirement savings, the higher contribution limits permitted through cash balance plans are appealing, allowing them to amass more pretax dollars. In 2018, the contribution limits in total employer and employee contributions for cash balance plans was $194,000 for a 55-year-old, $254,000 for a 60-year-old, and $266,000 for a 65-year-old. With such high contribution limits, eye surgeons can certainly accelerate their retirement savings.

Another advantage of cash balance plans is that they can be customized to reward varying employee levels within an organization, from surgical practice partner to staff member; different dollar amounts can be credited to each level of partner and employee. Also, the plans are qualified by the US Internal Revenue Service, tax-deferred, secured under the Employee Retirement Income Security Act, and protected from creditors.

Participants in cash balance plans receive an annual pay credit from the practice—a percentage of compensation or a flat dollar amount—as well as an interest credit at a fixed or variable rate linked to an index. The plan’s investments are professionally managed, and the practice or medical partnership bears the risk of the investments. Because the rate of return is guaranteed and not dependent upon performance, the ups and downs of the plan’s investments do not have a direct impact on the benefit amounts received by participants.

At retirement age, participants can make a choice about how they wish to receive their retirement earnings; distributions can be taken as an annuity or as a lump-sum benefit that can be rolled over into an individual retirement account (IRA) or another employer’s plan. The common practice—and the recommended one—is to take the distribution as a lump-sum benefit.

As with traditional defined-benefit pension plans, partners in an eye surgery practice work together with their plan manager to try to match assets (plan balances) and liabilities (future payouts). Additionally, once a cash balance plan is established, employers are required to make contributions to employees’ plans each year, so medical practices offering this benefit must have stable profits and cash flow year over year. Also, the actuarial and administrative expenses required for plan oversight are more costly than those of other plan types. Administrative fees usually range from $2,000 to $10,000 annually, and investment management fees can be 0.25% to 1.00% of assets.

From the employee’s perspective, shifting to a cash balance plan from a traditional pension plan can result in diminished benefits. Traditional pension plan payouts are usually linked to an employee’s highest annual earnings, whereas cash balance plan payouts are linked to earnings across the working history, from lowest to highest earnings. But, having the option of a guaranteed annuity that these plans provide can be attractive to employees.

INVESTING IN AN OFFICE BUILDING OR ASC

Ownership of a medical office building or ASC offers eye surgeons an opportunity for additional income, and the building itself is a potentially valuable asset. The building may continue to generate income for the owner even after he or she retires and no longer treats patients.

By establishing a separate limited liability company, or LLC, to purchase a medical office building, the eye surgeon and his or her partners can become the landlords of their own medical practice. They can earn additional rental income as well if the building houses other tenants.

Owning a medical office building has the potential to be lucrative, but care must be taken to understand all of the ongoing costs associated with property ownership, such as utilities and maintenance. In addition, the partners should buy opportunistically (not overpay) and make judicious use of leverage prior to purchase.

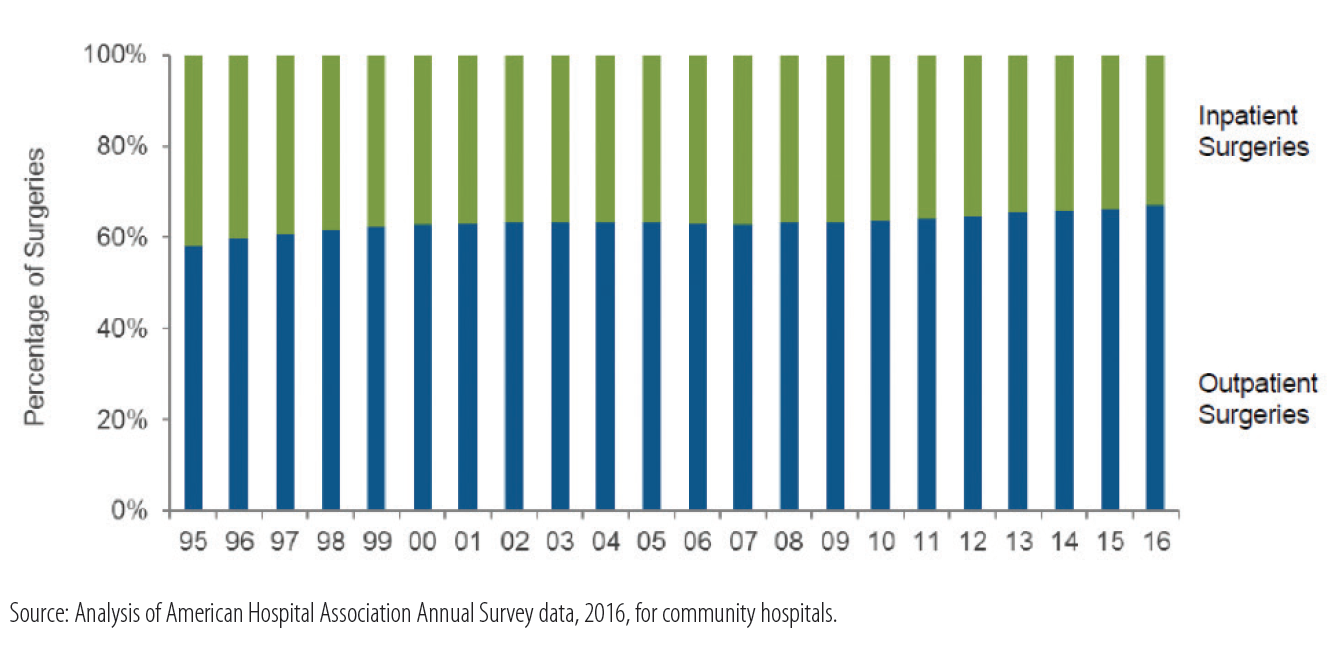

ASC ownership can be another way to earn a profit. As the Figure illustrates, there has been a slow—but steady—upward trend in the percentage of surgeries performed in an outpatient setting over the past 20 years.

Figure. Percentage of inpatient versus outpatient surgeries, 1995 to 2016.

Historically, ASCs have shown the potential for outstanding profit margins, but investment eligibility is often contingent upon one’s being a participating surgeon who performs surgeries at the center. Also, investing in an ASC might be prohibited by one’s private practice or hospital.

Of note, the amount of income that surgeons can earn with this sort of investment is based on production; if a surgeon stops operating or reduces surgical volume, he or she can be removed from the partnership, with often unfavorable terms.

ASC investment comes with additional potential risk factors. Eye surgeons would be wise to gain an understanding of the following investment terms that, if not favorable, could negatively affect the ASC’s success:

- Process for bringing in a new investor (Who is allowed to invest in the ASC, and how many will be allowed to invest?);

- Processes and restrictions on the transfer of ownership shares as well as policies for distributions and redemptions;

- How ownership unit pricing is determined;

- Protocols for conflicts of interest;

- Details of noncompete clauses; and

- Policy for the grandfathering of existing interests in competitors.

If an ASC is newly established by an eye surgeon and his or her investment partners, they must carefully create guidelines for all of the aforementioned.

CONCLUSION

Given their additional years of education, likely medical school debt, and delayed savings, cataract and refractive surgeons must be creative when planning for retirement. Partners in an eye surgery practice would be wise to weigh the pros and cons of establishing a cash balance plan for employees. Although there are drawbacks, these plans can offer a guaranteed retirement benefit to a team of employees while simultaneously facilitating greater tax-deferred retirement savings for partners. Investing in a medical office building or ASC is another potentially powerful wealth management and income-producing strategy.

1. Youngclaus J. An updated look at attendance cost and medical student debt at U.S. medical schools. Analysis in brief. August 2017. American Association of Medical Colleges. https://www.aamc.org/download/482236/data/august2017anupdatedlookatattendancecostandmedicalstudentdebtatu.pdf. Accessed November 19, 2018.