A breakdown of hot options for the correction of myopia, presbyopia, astigmatism, and hyperopia.

By Richard L. Lindstrom, MD

In parallel with the Great Recession in 2008, many refractive surgeons reported a decline in surgical volume. At that time, the procedure that seemed to take the biggest hit was LASIK—but then again, it was one of only a few procedures available for the surgical correction of refractive error. Since the economy rebounded, so has refractive surgery volume in most cases. We continue, however, to hear reports of lower procedure rates from some practitioners. Why is this?

According to Market Scope’s 2018 Refractive Report,1 better spectacle and contact lens technologies are to blame for the dip in the refractive market, along with a shift in patients’ visual demands due to their increased use of digital devices.

But good news is on the horizon, as the report also points to a healthy increase in the global demand for refractive surgery between 2018 and 2023. Market Scope anticipates a compound annual growth rate of 5.2% and an increase in annual surgical volume of 1.2 million procedures, from 2.3 million in 2018 to 5.5 million in 2023. The report also indicates that the demand for refractive surgery grew in the United States, Japan, and some countries in Western Europe in 2018, and it forecasts modest growth in the demand for refractive surgery procedures in response to technological advances, continuing economic improvement, and rising rates of myopia in developed nations. Given this information, the refractive surgery market seems to be doing quite well.

GROWING THE MARKET

It continues to be our job as refractive surgeons to grow the market. And new developments that aim to treat one of the four main refractive errors—myopia, presbyopia, astigmatism, and hyperopia—can help us to achieve that goal. Let’s look at each refractive error individually to identify which procedure has the most potential to grow the market in refractive surgery.

Myopia. In the United States, about 40% of the population has myopia.2 In other parts of the world and in certain populations, that percentage can reach the low 90s, as is the case in school-aged children in Asia.3 The most likely drivers of growth in myopic vision correction surgery over the next 5 to 10 years are LASIK, PRK, and small-incision lenticule extraction (SMILE). At this time, I don’t see anything on the horizon that has the potential to be better than these three procedures.

The existing challenge with myopic correction is that we have exhausted the current pool of candidates. The next best candidates for this type of surgery are millennials, and they currently prefer contact lenses as an alternative to glasses. The average age of contact lens wearers is 31.

It is also worth mentioning that pharmaceutical therapy for refractive errors is growing in popularity. One treatment option for patients with progressive myopia is low-dose atropine. (Editor’s note: For more on the increasing prevalence of myopia, see “Myopia: A Global Epidemic,” by Neesurg Mehta, MD; and Angie Wen, MD, on page 30.)

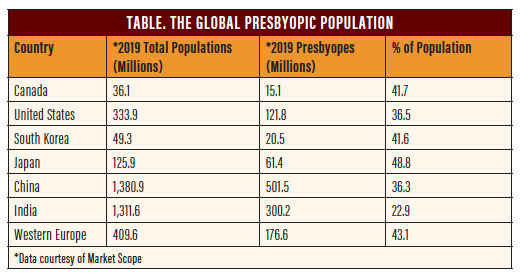

Presbyopia. The second most common refractive error is presbyopia. According to Market Scope research, 36.5% of the US population and about 25% of the world’s population is presbyopic (Table).5

We are still in search of a surgical procedure that can gain broad traction in the presbyopic market. The most promising is the allogenic lenticule (TransForm Corneal Allograft, Allotex, not approved by the FDA), which is an alternative to synthetic corneal inlays. Sheraz M. Daya, MD, FACP, FACS, FRCS(Ed), FRCOphth, implanted the first lenticules in the world in June. If we find that this technology works as well as projected and that it offers greater safety than the synthetic corneal inlays with which we have experience, I expect to see some growth in this area of refractive surgery.

The challenge once again is that contact lenses for presbyopia are popular and more advanced than previous generations. Another area of development that challenges the growth of surgical vision correction for presbyopia is pharmacologic agents that are designed to constrict the pupil in order to treat the symptoms of presbyopia.

If I had to pick one treatment for presbyopia that has the greatest potential to grow the market, it currently would be refractive lens exchange with presbyopia-correcting IOLs, particularly if we can get into the next generation of truly accommodating IOLs. The most logical way to restore function to the human crystalline lens is to replace it, and I think the best options for replacement are monovision and presbyopia-correcting IOLs.

Scleral implants such as the VisAbility Micro-Insert System (Refocus Group) and scleral surgery such as laser anterior ciliary excision (LaserACE, ACE Vision Group) are treatments for presbyopia, but both are moderately invasive and still under investigation.

Astigmatism. The next most common refractive error, astigmatism, is present in the eyes of about 30% of the US population.

Refractive lens exchange with a toric IOL can be an attractive option for older astigmatic patients. In some cases, refractive lens exchange can be paired with a corneal relaxing incision to correct high degrees of astigmatism.

Hyperopia. The least common refractive error is hyperopia. Patients who most often seek correction for hyperopia are between the ages of 30 and 40. Desire for hyperopic correction frequently coincides with the onset of presbyopia.

For patients who require a small hyperopic correction, LASIK, PRK, and SMILE again are the procedures with the most potential to grow the market. For older hyperopes and for patients who require a large hyperopic correction, however, the best treatment is likely refractive lens exchange.

CONCLUSION

No one procedure has the most potential to grow the market in refractive surgery. The type and severity of refractive error to be treated, the age of the patient, and even the level of surgeon comfort demand a variety of surgical options.

If I were forced to pick winners, though, I would nominate the laser vision correction umbrella of procedures (LASIK, PRK, and SMILE) for correcting myopia, astigmatism, and hyperopia and refractive lens exchange for correcting presbyopia—with the caveat that older patients with astigmatism and patients with high hyperopia often do better with refractive lens exchange.

1. Global demand for refractive surgery growing after economic rebound in major markets. https://eyewire.news/articles/global-demand-for-refractive-surgery-growing-after-economic-rebound-in-major-markets/. Accessed July 10, 2019.

2. Ossala A. Nearly 5 billion people will be nearsighted by 2050. https://www.popsci.com/nearly-5-billion-people-will-be-nearsighted-by-2050/. Accessed July 10, 2019.

3. Park A. Why up to 90% of Asian schoolchildren are nearsighted. http://healthland.time.com/2012/05/07/why-up-to-90-of-asian-schoolchildren-are-nearsighted/. Accessed July 10, 2019.

4. Morgan PB, Woods CA, Tranoudis IG, et al. International contact lens prescribing in 2012. Contact Lens Spectrum. https://www.clspectrum.com/issues/2013/january-2013/international-contact-lens-prescribing-in-2012. Accessed July 10, 2019.

5. Black S. Presbyopic options in refractive surgery. COPE 46371-R. http://www.optometrysmeeting.org/documents/handouts/2016/3100.pdf. Accessed July 10, 2019.

6. Astigmatism. https://www.summiteyekc.com/blog/astigmatism. Accessed July 10, 2019.

A tie between two treatments—one corneal and one lenticular.

By Vance Thompson, MD, FACS

There are two procedures I think of as having the greatest impact on modern refractive surgery; one is corneal, and the other is lenticular. Vance Thompson Vision was involved in the FDA-monitored clinical trials and the commercial releases of the technologies required in each procedure, so my colleagues and I have firsthand with the impact they can have on a refractive surgery practice.

CORNEAL SURGERY

The corneal procedure that I believe has the most potential to grow refractive surgery is SMILE. I tell my patients that SMILE candidates are basically the same as LASIK candidates. I also tell them that, if it were I undergoing refractive surgery, I’d rather have a well-centered SMILE treatment than a well-centered LASIK treatment—as long as I was a good candidate for both.

In both procedures, centration is paramount. In LASIK, even if the femtosecond laser flap can’t be centered perfectly because of corneal anatomy or orbital fit challenges, the all-important excimer laser ablation can be centered perfectly once the flap has been lifted. In SMILE, it is rare that the laser treatment is not perfectly centered, but, when it is not, we choose to convert to LASIK. The more SMILE procedures we have performed, the more comfortable we have become with centration.

The reason that I select SMILE as the corneal procedure with the most potential to grow the market is that it is one of the most exquisite corneal refractive procedures I have ever performed. The procedure’s small sidecut and easily centered treatment make a positive impact on patients and referring doctors. I feel that SMILE has helped move the needle in laser vision correction more than any other contemporary procedure.

LENTICULAR SURGERY

In the lenticular space, the Light Adjustable Lens (RxLAL; RxSight) is a game-changer. My involvement in the FDA-monitored clinical trials of the RxLAL allowed me to implant it in patients several years before the product’s commercial availability, and even early on I was amazed by how much our patients and referring doctors loved the idea of an IOL that can be customized inside the eye 3 weeks after surgery. Many patients select the RxLAL because of its adjustability, customizability, and precision, and today this lens is the fastest-growing technology in our practice.

In my experience, no lens on Mother Earth is more accurate and precise than the RxLAL. I believe the RxLAL has the greatest potential as a lenticular procedure to grow refractive surgery because it compresses patients’ vision correction journey from 4 to 6 months, which is typical with other lenticular solutions, to 3 to 5 weeks. Here is why: With multifocal and extended depth of focus IOLs, fine-tuning with a laser is typically performed 3 months after implantation, and it also is not unusual to perform an Nd:YAG laser capsulotomy 4 to 6 months after surgery. On the other hand, the RxLAL currently is locked in 3 to 5 weeks after implantation.

The lens is available as a monofocal. Either both eyes can be corrected for distance (the patient will need readers) or one eye can be corrected for distance and the other for near to create precision monovision. In the future, it is to be hoped that the RxLAL will become available in extended depth of focus and multifocal models.

CONCLUSION

I believe that SMILE in corneal refractive surgery and the LAL in lenticular surgery are here to stay and will greatly influence the worlds of refractive and cataract surgery.