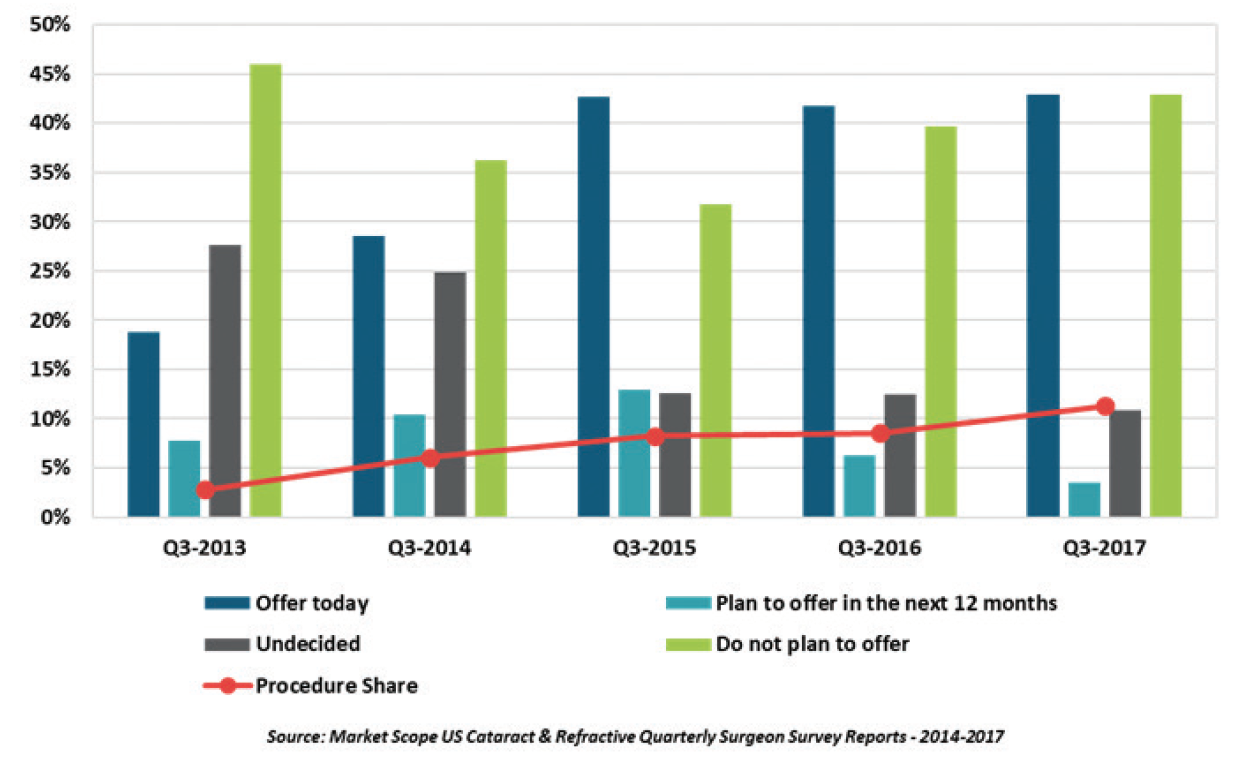

Recent market data analyzing the adoption rate of laser cataract surgery show that the total market share for the procedure continues to increase, but that new surgeon adoption has stalled in recent years.

According to the ophthalmic research company Market Scope,1 based on its survey data, the percentage of surgeons who reported plans to offer laser cataract surgery showed steady growth for several years, increasing from 19% in the third quarter of 2013 to 29% in 2014 and to 43% in 2015.

In the 2 years that followed, however, surgeon adoption plateaued: 42% of survey participants offered laser cataract surgery in 2016, and 43% in 2017. Additionally, surgeons who reported plans to offer laser cataract surgery also decreased in the past 2 years, with 6% reporting plans to do so in the next 12 months in 2016 and 4% in 2017 (Figure 1).

Figure 1. US surgeons’ adoption and procedure share of laser cataract surgery.

The percentage of survey respondents who were undecided about laser cataract surgery has also decreased. In 2014, 25% of surgeons reported that they were undecided on the technology; this decreased to 13% in 2015 and to 11% in 2017. Conversely, surgeon respondents with no plans to offer laser cataract surgery increased, with 32% reporting no plans in 2015, 40% in 2016, and 43% in 2017 (Figure 1).

Images courtesy of Market Scope

Figure 2. US surgeons’ plans to offer laser cataract surgery.

Although surgeon adoption of laser cataract surgery may have stabilized, the procedure’s share of the refractive surgery market has continued to increase. Market share is currently 11.3% in the United States and 1.5% outside the United States, according to another Market Scope report.2 The US market share has grown continually, from 2.8% in 2013 to 6.1% in 2014, 8.3% in 2015, and 8.5% in 2016.

“Based on feedback from our surgeon survey participants, we suspect that, while the number of new surgeons adopting [laser cataract surgery] has stalled, those with the technology continue to use it, and, in some cases, more frequently,” Market Scope Director of Operations Tony Ingenito told CRST. “These surgeons have effectively leveraged the marketing advantage of [laser cataract surgery], and in doing so have pushed competing practices to also adopt the technology.”

Mr. Ingenito added that outcomes and surgical times have also played a role in the plateau in laser cataract surgery procedures.

“The debate over proven clinical outcomes has remained fierce among surgeons, both in the United States and the European Union, and without more unanimous, conclusive evidence of significantly improved outcomes, the cost-benefit ratio is simply too great for many surgeons,” he said. “There are also concerns about efficiency, as many surgeons have experienced an increase in per-case time with [laser cataract surgery].”

Michael Lachman, president of ophthalmic market research company EyeQ Research, said the plateau in adoption of laser cataract surgery can be attributed to a variety of factors, including the cost of manufacturing the technology, which is typically passed along to the customer (ie, the surgeon).

“Femtosecond lasers are fundamentally expensive to manufacture, so there’s an underlying cost element from the company’s standpoint. You can get creative with how you charge for laser technology—through financing, leasing, or procedure-based deals—but ultimately the manufacturers have to recoup the high cost of the lasers,” Mr. Lachman said. “Without some fundamental change in the underlying cost of the technology, increases in [laser cataract surgery] adoption will probably be incremental from here.”

Also standing in the way of a more robust adoption rate is competing technology in the premium space, he suggested. Laser cataract surgery and premium IOLs compete for the same patient self-pay dollars. Premium IOL technologies have improved, and lens surgery provides patients a long-lasting benefit. Extended depth of focus lenses and the latest generation of low-add multifocals and toric multifocals have received high marks from cataract patients and surgeons. And new technologies, such as the Light Adjustable Lens (RxSight), which obtained FDA approval in November 2017, may mean even more competition for self-pay dollars.

“I think you could make the case that a lens that provides better vision and reduced spectacle dependence after surgery delivers a more tangible and lasting clinical benefit for the patient than a laser that helps facilitate the procedure,” Mr. Lachman said.

“There’s not 100% consensus on this, but I think most people would agree that [laser cataract surgery] provides benefits in both safety and refractive outcomes,” he said. “It comes down to a question of how meaningful these benefits are, and at what cost. At a low enough cost, [laser cataract surgery] would be very widely adopted because it’s probably better medicine. But the reality is we’re in a very cost-constrained health care environment, and, even on the self-pay side, there are other technologies that are competing for these dollars, most notably lenses.”

1. Market Scope. 2017 Annual US Cataract Surgeon Survey Report. https://market-scope.com/products-page/cataract-reports/2017-annual-us-cataract-surgeon-survey-report/. Accessed January 22, 2017.

2. Market Scope. 2017 Cataract Equipment Report. https://market-scope.com/products-page/cataract-reports/2017-cataract-surgical-equipment-report-a-global-market-analysis-for-2016-to-2022/. Accessed January 9, 2017.